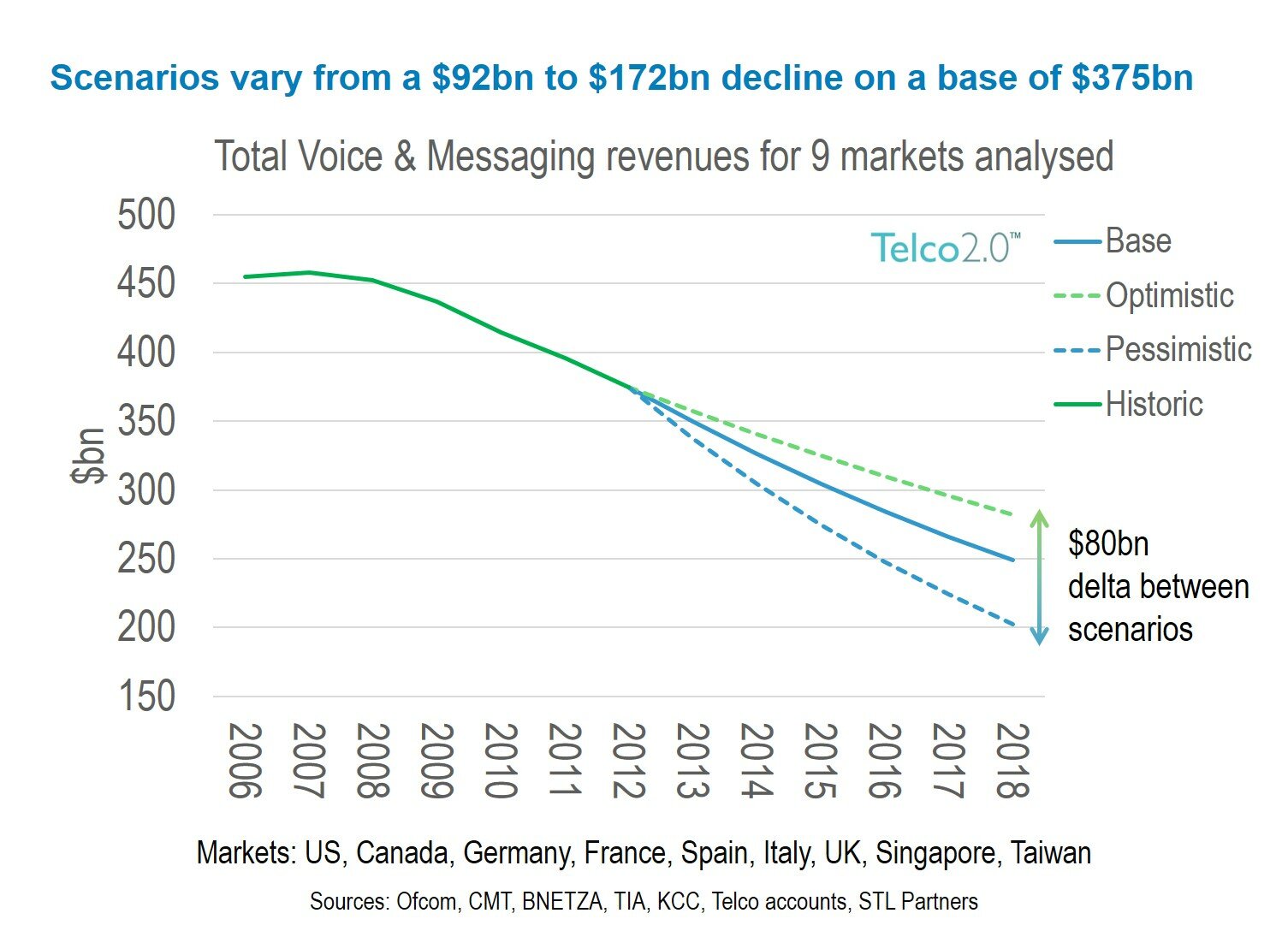

The research shows that Telcos can fight to reduce this loss by $80bn through intelligent optimisation of prices and bundles, service enablement, exploiting new standards such as WebRTC and VoLTE, creative approaches to own brand OTT services, and a greater focus on enterprise communications.

Over the next 5 years Telecoms operators face significant further declines in traditional service revenues due to so-called ‘Over The Top’ (OTT) competition, vulnerable pricing structures, economic pressures and societal changes. But telcos can still influence the ultimate outcome with intelligent strategies.

A major new report by the Telco 2.0 Initiative shows how telcos can slow the decline of voice and messaging revenues and build new communications services to maximise revenues and relevance with both consumer and enterprise customers.

It includes detailed forecasts for 9 major developed markets (US, Canada, France, Germany, Spain, UK, Italy, Singapore, Taiwan), in which the total decline is forecast between $92bn (-25%) and $172bn (-46%) on a $375bn base between 2012 and 2018, giving telcos an $80bn opportunity to fight for.

The report also shows impacts and implications for other technology players including vendors and partners, and general lessons for competing with disruptive players in all markets. It looks at the impact of so-called OTT competition, market trends and drivers, bundling strategies, operators developing their own Telco-OTT apps, advanced Enterprise Communications services, and the ability to exploit new opportunities and standards such as Service Enablement, WebRTC and VoLTE.

“Perhaps the most surprising thing is how effective some telco strategies have been in defending against disruptive competitors like WhatsApp. Then again, there are some markets, such as Spain, where the combination of telco pricing and economic conditions have played right into the hands of the so-called ‘OTT Players’”.

“Equally, there are some great opportunities for telcos to build new value, particularly in the Enterprise market, where some of the more traditional technology companies like Cisco face increasingly disruptive competition from players like Google and Microsoft.”

This report provides an independent and holistic view of voice and messaging market, looking in detail at trends, drivers and detailed forecasts, the latest developments, and the opportunities for all players involved. The analysis will save valuable time, effort and money by providing realistic forecasts of future potential, and a fast-track to developing and / or benchmarking a leading-edge strategy and approach in digital communications.

It contains:

Established in 2006 by analyst and consulting firm STL Partners, the Telco 2.0 Initiative helps drive the transformation of the telecoms industry, looking in particular at new business models and service innovation. It is highly influential on the strategies of the leading players in the market.

“Our focus is on driving transformation through business model innovation in the Telecoms, Media and Technology sector – i.e. how companies make money and grow in turbulent times.”

The Initiative publishes ongoing research into new business model strategies, and runs regular high level 'executive brainstorms' in 4 continents (Europe, APAC, Middle East, Silicon Valley). These bring senior execs in the telco industry together with their peers in other sectors (banking, advertising, media, retail, etc.) to explore new opportunities for collaborative growth.

Research: telco2research.com

Executive Brainstorms: www.newdigitaleconomics.com/events

“Most of the telcos and technology companies around the world subscribe to our research, participate in our brainstorms, and use our consulting services, due to its unique focus and methodologies. We also work closely with the World Economic Forum in the area of ‘personal data’ and have a seat on their global ICT agenda council.”

Simon Torrance, CEO, STL Partners / Telco 2.0.

For more information on this release please contact: Hayley Brace, Marketing Director, Telco 2.0 / STL Partners.

Call: +44(0) 207 247 5003 or Email: