Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

|

Summary: Digital initiatives are an important part of the telecoms growth story. However, because they are so different to the traditional telecoms business, they require different performance metrics: a digital dashboard. In this report, we examine the importance of metrics in shaping business performance, explore the contribution of metrics to 3 telco digital success stories, and reveal how a cutting-edge approach to metrics is driving digital execution at Telkom Indonesia. (February 2015, Telco 2.0 Transformation Stream)

|

|

Below is an extract from this 41 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Transformation Stream here.

For more on any of these services, please email / call +44 (0) 207 247 5003.

As core services revenues, margins and cash generation decline quickly, Communications Service Providers (CSPs) are seeking to invest in and grow new (digital) services. STL Partners estimates that digital business should represent 25+% of Telco revenue by 2020 to avoid long-term industry decline. The move to digital is challenging for CSPs. It will require large established organisations to define and implement new sustainable business models with new services delivered to existing and new customers via new channels and partners underpinned by new technology and supported by new operating, revenue and cost models. This requires a fundamental shift from a traditional infrastructure-based business to a complex amalgam of infrastructure, platform and product innovation businesses:

The Internet has changed everything by fracturing the integration between the network and services so that voice and messaging are no longer the sole domain of CSPs. CSPs now need to continue to hone their infrastructure business skills (in a world where every dollar of revenue is competed for hard by other operators and by ‘OTT’ players), and must also develop a range of new skills, assets, partnerships, customer relationships and operating and financial models if they are to compete in the new digital service areas.

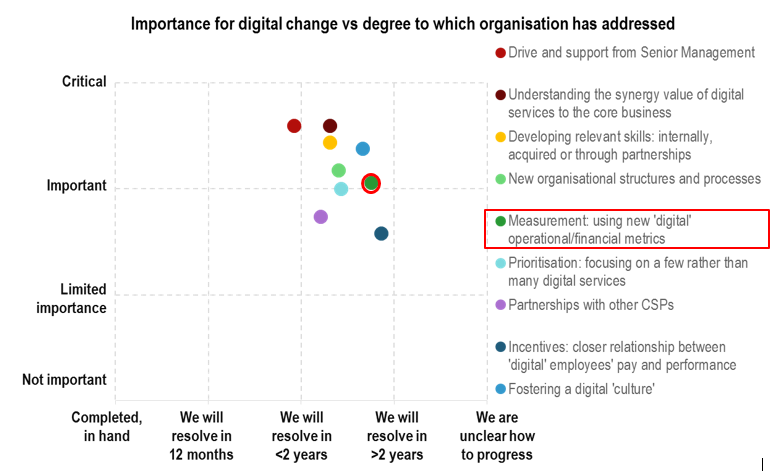

In our recent survey (see Reality Check: Are operators’ lofty digital ambitions unrealistic given slow progress to date?), Telco practitioners were asked to comment on the importance of nine things that needed to be addressed to complete their digital business model transformation and the progress made to tackle them (see Figure 1).

Source: STL Partners/Telco 2.0 Operator Survey, November 2014

Measurement using new digital operational/financial metrics was highlighted in the global survey as one of the ‘big 6’ challenges that need to be addressed for CSPs to be successful in future. However, to date, it has often been neglected by CSPs (metrics are often an after-thought and not an integral part of the digital transformation process).

In this report, we argue that the reverse is true: effective metrics lie at the heart of change. Without measurement, it is impossible to make decisions and engender change: an organisation continues on its existing path even if that ultimately leads to decline. We will:

There is a common misconception that start-ups and digital companies do not – and do not need to – measure and report the performance of their businesses and initiatives. Digital start-ups are often portrayed as small creative teams working on ‘exciting stuff’ with no sense of business rigour or control. This could not be further from the truth. Most start-ups follow a LEAN & agile approach to product ideation and development are steered by one motto… “What you cannot measure, you cannot manage”. This is even more true if they are VC-backed and therefore reliant on hitting specific targets to receive their next round of funding.

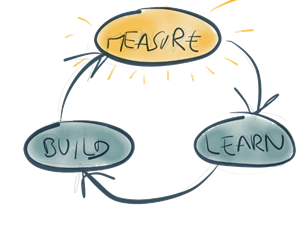

Start-ups rely on operational and actionable metrics to measure progress, identify when to pivot as an organisation and translate strategic objectives into daily activities. By applying the “Build – Measure – Learn” concept (see Figure 2), innovators create something (Build), evaluate how well it is received (Measure), and adjust it in response to the feedback they receive (Learn).

Source: LEAN Analytics – Use Data to Build a Better Startup Faster

Metrics evolve over time. Start-ups are continuously searching for the ‘right’ metrics at any given stage of their development because their businesses are constantly evolving – either because they have just started on their journey or because they may have recently changed direction (or ‘pivoted’ from their original value proposition). Metrics are perceived as an operational toolset to quickly iterate to the right product and market before the money runs out. This ‘sword of Damocles’ hanging over entrepreneurs’ heads is a world away from the world inhabited by telcos’ employees.

Indeed, CSPs’ current approach to business targets & funding allocation is unlikely to create a sense of urgency that will drive and stimulate the success of digital initiatives. Based on extensive interviews with CSPs, digital start-ups and VCs, STL Partners concludes that CSPs should focus on:

Removing the Telco ‘safety net’. To succeed in creating truly compelling customer experiences CSPs need to mimic a VC-like environment and create a culture of higher-reward in return for higher risk by targeting employees more tightly on their digital initiative’s performance:

Reward success more heavily: this could be ‘shadow’ share options in the venture which yield value in the form of shares or cash bonus for hitting targets which would takes an employee’s overall package way beyond what could be earned in the core business.

Create risk for individuals: the quid pro quo of a big upside could be a reduced salary to, say, 60% of normal Telco pay (i.e. similar to what might be earned in a typical start-up) or offer contracts that only renew if an initiative hits its targets – if you fall short, you leave the business and are not simply moved elsewhere in the organisation.

Adopting ‘start-up culture’ and ways of thinking. For example, when negotiating for funds, employees should be negotiating for their survival, not for a budget or a budget increase. Also, Telcos should start using the vocabulary / parlance commonly used in the digital space as such burn rate, time before cash runs out, cash break-even date, etc.

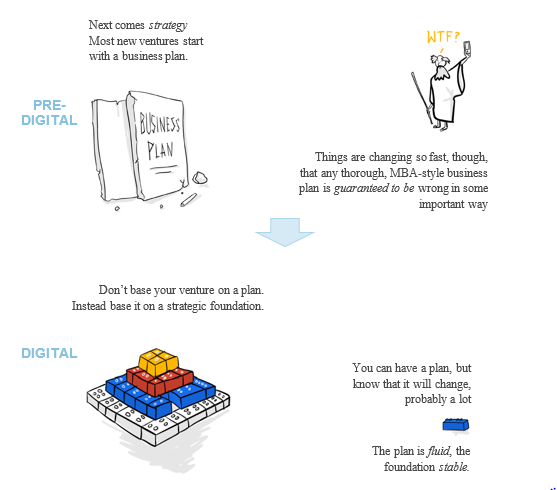

Establishing new processes to manage KPIs and performance metrics. In the fast-paced digital environment, it usually does not make sense to use 18-24 month targets derived from a detailed business case backed by financial metrics (such as revenue, EBITDA, etc.) – particularly for early-stage start-ups. Google actually identified a move away from this approach to one focused on a stable strategic foundation (make sure the initial proposition is viable by defining a clear problem we are trying to solve and how the solution will differentiate from alternative solutions) + fluid plans as one of the pillars of its success (see Figure 3)

Source: How Google works, Eric Schmidt, Jonathan Rosenberg and Alan Eagle

Metrics are a powerful tool that CSPs should use to foster sustainable commercial growth through validated learning. Unfortunately, metrics are often an “after-thought” and very few CSPs have implemented a consistent approach to metrics. From a series of interviews, undertaken by STL for this research, it became apparent that most initiatives failed to develop regular reporting that engages (or is even understood by) other stakeholders. At best, operators are inconsistent in tracking digital innovation, at worst, negligent.

To access the rest of this 41 page Telco 2.0 Report in full, including...

...and the following report figures...

Figure 1: Digital metrics should be driving change at CSPs but are themselves proving difficult to implement

Figure 2: “Build – Measure – Learn” concept

Figure 3: Business plan and financial metrics are out-of-date in a digital world

Figure 4: Near perfect correlation between number of agents and number of M-Pesa subscribers, R2 = 0.96

Figure 5: Metrics reporting by M-Pesa, December 2012

Figure 6: Turkcell’s Mobile Marketing Platform Overview

Figure 7: Turkcell’s continuous development of it Mobile Marketing portfolio

Figure 8: Libon single roadmap enables rapid evolution and rich features

Figure 9: Libon – Cost per Monthly Active Users (M)

Figure 10: Illustrative Net Synergy Make up (Hypothetical case)

Figure 11: Facebook vs. Yield Businesses: Revenue and Enterprise Value (EV)

Figure 12: Facebook: Monthly Active Users vs. Valuation

Figure 13: Different players’ metrics requirements

Figure 14: Balance Scorecard concept

Figure 15: AARRR model

Figure 16: Pros & Cons – Summary table

Figure 17: Telkom Indonesia’s Metrics Approach - Characteristics

Figure 18: Telkom Indonesia’s digital strengths

Figure 19: Telcos – slow by design?

Figure 20: Telkom Indonesia’s TIMES service portfolio

Figure 21: LEAN start-up approach

Figure 22: Delivering Innovation – Telkom’s internal organisation

Figure 23: Telco 2.0 Domain Framework

Figure 24: Metrics Prioritisation & Outcomes Example

Figure 25: Governance process – Phase 1 & 2

Figure 26: Innovation Governance – Case studies examples

...Members of the Telco 2.0 Transformation Stream can download the full 41 page report in PDF format here. Non Members, please subscribe here. For other enquiries, please email / call +44 (0) 207 247 5003.

Title:The Digital Dashboard: How new metrics drive success in telco digital initiatives