|

| Digital Economy 2.0: A write up, analysis and record of the debates, verbatim feedback and voting from the six sessions on ‘The Digital Economy 2.0’ from Day One of the New Digital Economics Silicon Valley Executive Brainstorm, held on the 27th March 2012, Marriott Hotel, San Francisco. |

|

Part of the New Digital Economics Executive Brainstorm series, the Digital Economy 2.0 session on Day One of the New Digital Economics Silicon Valley event took place at the Marriott Hotel, San Francisco, on the 27th March, 2012.

Using a widely acclaimed interactive format called ‘Mindshare’, the event enabled over 200 specially-invited senior executives from across the communications, media, retail, finance and technology sectors to explore new business models and growth opportunities.

This report summarises the high-level findings and includes the verbatim output and voting from the brainstorming tools.

More information: Andrew Collinson, Research Director, STL Partners.

Email: . Phone: +44 (0) 207 247 5003.

DOWNLOAD REPORT

With thanks to our Platinum Sponsors:

Table of Contents:

- Introduction

- Contents

- Table of Figures

- The Market, 2.0

- Panel Discussion

- Delegate Votes

- Key Takeaways

- Next Steps

- Verbatim Feedback

- Digital Consumer 2.0

- Panel Discussion

- Delegate Votes

- Key Takeaways

- Next Steps

- Verbatim Feedback

- Connected Devices 2.0 – Beyond the Phone

- Panel Discussion

- Verbatim Feedback

- Key Takeaways

- Next Steps

- Innovation Showcases

- Billing 2.0 – Dynamic Revenue Management

- Customer Support 2.0 – Monetising the Connected Home

- Verbatim Feedback

- Digital Infrastructure 2.0: Connectivity & Cloud

- Panel Discussion

- Delegate Votes

- Key Takeaways & Next Steps

- Next Steps

- Verbatim Feedback

- Big Data meets Personal Data

- Verbatim Feedback

- Appendix A – Event agenda

- Appendix B - Event Participants

- About STL Partners

Table of Figures:

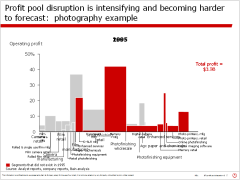

- Figure 1: Disruption in the photo industry, 1995-2005

- Figure 2: Comparing margins across the online consumer sector

- Figure 3: Strategy vectors among the platform players

- Figure 4: Prioritising the battlefields of the Great Game

- Figure 5: Key market strategies for operators

- Figure 6: Delegate vote on key platform companies’ prospects

- Figure 7: Delegate vote – should operators be commerce platforms, and can they do it?

- Figure 8: Can mobile move from brand building to lead generation?

- Figure 9: The changing smartphone ecosystem

- Figure 10: The importance of the right verbs

- Figure 11: Loyalty cards – Green Shield 2.0?

- Figure 12: Overtracking

- Figure 13: Delegate vote on consumer adoption rates

- Figure 14: The diversity of M2M business models

- Figure 15: The challenge of Devices 2.0

- Figure 16: Dynamic revenue management

- Figure 17: Defining the segment

- Figure 18: The vital import of service in your brand

- Figure 19: Bain forecasts for business cloud market size

- Figure 20: Key barriers to cloud adoption

- Figure 21: Identifying the cloud growth markets

- Figure 22: Requirements for success

- Figure 23: Many clouds

- Figure 24: Cloud traffic in the data centre

- Figure 25: Ericsson vision for telco cloud

- Figure 26: Summary of Ericsson cloud functions

- Figure 27: Aepona Cloud Services Broker

- Figure 28 – Vote on Telco Cloud Market Share

- Figure 29: How personal clouds and merchant clouds could interact

- Figure 30: How Personal.com protects personal data

- Figure 31: Unbound’s platform can deliver personalised advertising