|

| Digital Entertainment 2.0: A summary of the Digital Entertainment 2.0 session, held on the 28th March 2012, Marriott Hotel, San Francisco, part of the New Digital Economics Silicon Valley event. The Brainstorm explored how reduce complexity in Mobile Video, the opportunities in Social TV, new ways to monetize content in a multi-platform world, and the role of telcos in creating alternative enabling platforms. |

|

Part of the New Digital Economics Executive Brainstorm series, the Digital Entertainment 2.0 session took place at the Marriott Hotel, San Francisco, on the 28th March, 2012, part of the New Digital Economics Silicon Valley event. Using a widely acclaimed interactive format called ‘Mindshare’, the event enabled specially-invited senior executives from across the communications, energy and technology sectors to discuss and explore key strategic issues on the theme of ‘New Business Models in a multi-screen, 3D/HD, mobile world’.

Andrew Collinson, Research Director, STL Partners opened the meeting at 0900 and introduced the Digital Entertainment stream, the objectives for the session, briefed the delegates on the schedule and housekeeping and led the initial networking session.

This note summarises some of the high-level findings and includes the verbatim output of the brainstorm.

More information: Andrew Collinson, Research Director, STL Partners.

Email: . Phone: +44 (0) 207 247 5003.

DOWNLOAD REPORT

With thanks to our Platinum Sponsors:

Table of Contents:

- Introduction

- Contents

- Table of Figures

- Mobile Video: How to Reduce Complexity

- Panel Discussion

- Verbatim delegate questions & comments

- Conclusions and next steps

- Social TV: How to Create Compelling New Experiences

- Table & panel discussion

- Verbatim delegate questions & comments

- Conclusions and next steps

- Content Monetisation: How $$ will flow in a multi-platform world?

- Panel discussion and audience Q&A

- Verbatim delegate comments

- Conclusions and next steps

- Commerce, Content, and Connected Things – How can telcos bring them all together?

- Stimulus presentations

- Panel Discussion

- Key Takeaways

- Appendix A - Event Participants (total)

- About STL Partners

Table of Figures:

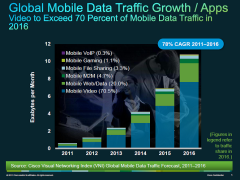

- Figure 1 - Cisco VNI forecast growth of mobile data traffic

- Figure 2 - Adoption of tablets & other examples of new consumer behaviour

- Figure 3 - An introduction to the Dyle mobile TV business model & technology

- Figure 4 - Dyle mobile TV form-factors

- Figure 5 - Dyle has multiple business & distribution models

- Figure 6 - Cautious optimism about Dyle model from audience poll

- Figure 7 - Slightly more negative view of European mobile TV prospects

- Figure 8 - Existing mobile TV use hints at positive Asia opportunity for Dyle

- Figure 9 - LG studies shows that a smart TV is still a TV

- Figure 10 - Can broadcasters avoid the fate of newspaper publishers?

- Figure 11 - Huge growth in simultaneous TV/social media use in 2011

- Figure 12 - Is SMS being negatively impact by always-on social media?

- Figure 13 - Not all users/viewers will be receptive to Social TV

- Figure 14 - Long-tail, long-form content coming from professional producers

- Figure 15 - YouTube offers considerable advertising model flexibility & innovation

- Figure 16 - Live TV will be heavily driven by social engagement

- Figure 17 - Live sports will have huge social network participation

- Figure 18 - Movie format is immersive – and therefore less social

- Figure 19 - News events are likely to trigger multi-channel usage

- Figure 20 - Entertainment spans a broad swathe of programming

- Figure 21- Documentary viewing is seen as a solitary activity

- Figure 22 - Timing is everything: video profitability depends on release windows

- Figure 23 - Online video – especially persistent VOD – is a disruptor

- Figure 24 - The simplicity of old content sales models replaced by complexity

- Figure 25 - Personalised, individualised content purchase channels

- Figure 26 - An appetite for anywhere access

- Figure 27 - Cloud storage business models still in experimental mode

- Figure 28 - 2017 is the tipping point for cloud content storage