Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

|

Summary: For mobile entertainment services to generate revenues commensurate to the attention they receive, the industry needs to improve 'discovery' tools, create more effective creative inventory, and deliver proof of its effectiveness. A summary of the Digital Entertainment 2.0 session of the 2013 Silicon Valley Brainstorm. (April 2013) |

|

Below are the high-level analysis and detailed contents from a 27 page Telco 2.0 Briefing Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service here. The Digital Economy, Consumer Experience (including service 'discovery'), Digital Commerce and the Internet of Things will also be explored in depth at the EMEA Executive Brainstorm in London, 5-6 June, 2013. Non-members can find out more about subscriptions here, or to find out more about this and other enquiries, please email or call +44 (0) 207 247 5003.

To share this article easily, please click:

Introduction

Part of the New Digital Economics Executive Brainstorm series, the Digital Entertainment 2.0 session took place at the Intercontinental Hotel, San Francisco, on the 20th March, 2013. The title and objective of the session was 'How to Make Mobile Work'.

The key steps for mobile entertainment services to generate revenues commensurate to the attention it receives in North America are: to improve measurement of the success of ‘discovery’ tools, create more effective creative advertising inventory, and deliver proof of its effectiveness, not just the attention.

Mobile has for some time been an entertainment media in the eyes of consumers, and particularly younger ones who soak up ‘dead time’ by playing games, using apps and even just communicating for fun, although to date not all these forms of entertainment have been connected.

In the past 3 years there has been a significant increase in ‘on demand’ and mobile consumption in North American and European markets, particularly in these younger segments, although a key challenge has been that monetisation has not followed the use of time spent on mobile.

Mobile entertainment itself can be defined as related to a context (e.g. ‘out and about’, ‘dead time’, ‘second screen’), devices (featurephone, smartphone or tablet), or type of connection (e.g. none, 3G, 4G, Wi-Fi). In general though, there are two main scenarios: mobile as a medium in its own right; and mobile as a ‘second screen’ experience. So in either scenario, we think the clearest answer to ‘what is the role of mobile?’ is that it is a ‘break out’ media, either extending the context of a form of entertainment, or extending the nature of entertainment in the existing context.

For video in North America, TV is still the dominant form of consumption, but mobile is growing rapidly as the ‘second screen’ that controls or supplements the main screen, especially with the explosive growth of tablets since the introduction of the Apple iPad.

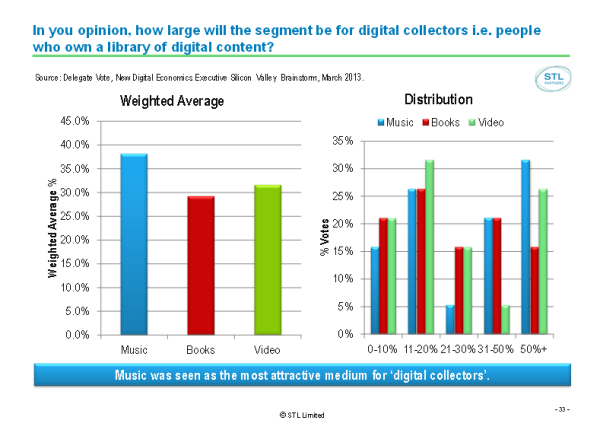

There has been much debate about the viability of different business models, broadly: advertising funded; consumer ownership; and subscription. While most participants believed that the ownership model would be most successful in music, where there is a higher likelihood that a consumer will want to listen to a track or album numerous times, ‘collectors’ or owners will still exist for videos, books and games.

Equally, demand exists for single ‘on demand’ services (e.g. pay per view), subscription (e.g. Spotify, cable), and advertising funded (e.g. YouTube). The balance is likely to change in video in particular with a move to increasing ‘on demand’ services in line with the current trend in consumer behaviour.

As the previously dominant channel-based model of curation in broadcast media gradually dissolves, and as the screen size, context and characteristics of consumption change, consumers face an increasing challenge finding out what they want to see, play or listen to.

Curation still exists through channel guides, taste-makers and review sites, and indeed through many offline sources, but is increasingly less the property of the content producer or distributor that it once was.

Content Discovery, one of the great buzz phrases of the industry, is therefore an ongoing challenge, and the application of networked computing power provide some advantages to connected and interactive devices like smartphones and tablets. Approaches used include:

For all methods, the inconsistencies of the metadata recorded (e.g. is the media described accurately using your terms) is frequently a challenging limitation.

To a degree though, content discovery has always been a process of ‘trial and error’. Consumers read, hear or see a load of ideas, try a few out, stick to the ones they like, and grow to trust the means of discovery that is most successful for them.

To this end, an element that appears to be missing in many discovery processes today is the measurement of success rate for the user – “was this a good recommendation for you”? In our view, discovery applications that accurately track success well (easily, with a good UI, and with a tangibly good and improving success rate) will ultimately prove successful. All of the above techniques could and to a greater or lesser extent do adopt this approach, although it isn’t yet clear which will perform the best in the market.

The challenges of delivering content, particularly large volume (e.g. HD Video) and/or latency sensitive content (such as multi-player virtual gaming), were not addressed in the Digital Entertainment session, though Software Defined Networking (SDN), which offers the promise of more efficient routing through networks for certain traffic, was discussed in the Digital Economy session. Content Delivery Networks and other Broadband design techniques have also been addressed at length in other STL Partners research and brainstorms

However, ‘Bandwidth’ was one of the key determinants of success according to the ‘BBC’ heuristic offered from Mitch Berman’s experience as a guide to how mobile entertainment will operate in different markets: Bandwidth; Business Model; and Culture. (NB We think this can also be seen as a shorthand variant of our business model framework, with culture being a key driver of the content proposition, bandwidth of the technical capability, and business model as the value proposition.)

A major challenge for advertising funded mobile entertainment is that there is a significant gap between the ratio of the amount of time spent viewing mobile and the money spent on it, and other forms of media. This is illustrated by the stats that:

While this imbalance is genuine, there are important advantages and limitations to mobile as a medium that haven’t yet been fully exploited or overcome, respectively.

One of the major limitations has been the need for more effective commercial inventory on mobile. At the Brainstorm there was, for example, much discussion on the limitations of banner type ads in a mobile environment. Many more innovative forms are now evolving, illustrated by:

In the same way that advertising has always evolved (from print to radio, radio to TV, etc.), there is still much to be learned through innovation and experimentation – and of course the related measurements of success.

Charging differently for content rights by content owners, e.g. by the use of content rather than as an upfront fee, was also discussed, although many content owners are reluctant to move to or even test this model as they see it representing a significant risk to existing revenue streams.

The digital economy core themes of ‘big data’ and ‘localisation’ were also raised, and an example given by the Weather Company of a highly effective promotion of grass seeds based on locality and the detection of key seasonal weather changes.

Finally, a key theme in common with the subsequent advertising session was that proving the effectiveness of models to consumers, brands, and investors was the key step for most mobile entertainment concepts. We see thoughtful design, coupled with trial and experimentation, effective measurement and the ongoing application of learning processes to be central to achieving that proof.

Effectiveness in the ‘discovery’ phase of digital service is a key success criterion, particularly in Digital Entertainment. We will continue to research and explore this area in our Executive Brainstorms in Europe, the Middle East, and Asia-Pacific.

To read the note in full, including the following sections detailing additional analysis...

...and the following figures...

...Members of the Telco 2.0 Executive Briefing Subscription Service can download the full 27 page report in PDF format here. Non-Members, please subscribe here. The Digital Economy, Consumer Experience (including service 'discovery'), Digital Commerce and the Internet of Things will also be explored in depth at the EMEA Executive Brainstorm in London, 5-6 June, 2013. For this or any other enquiries, please email / call +44 (0) 207 247 5003.

The 2013 Silicon Valley Brainstorm used STL’s unique ‘Mindshare’ interactive format, including cutting-edge new research, case studies, use cases and a showcase of innovators, structured small group discussion on round-tables, panel debates and instant voting using on-site collaborative technology. Around 30 executives from entertainment, media, telecoms and technology companies participated in this session in total.

The focus was on looking at “the true role for mobile” in the digital entertainment industry. Opening the session informally, various attendees were canvassed about their intentions & hopes for the day. This yielded a desire for information to assist in business modelling, to learn about the realities of the US entertainment market – or just to experience “inspiration and surprise” from a diverse set of speakers.

Objective: How to Make Mobile Work

The session covered three presentations and a demo, spanning the width of the entertainment business from TV to books, and from user behaviour to advertising. Its principle focus was around how content and telecom companies could generate sustainable businesses by leveraging the trend towards mobility – both devices and networks.

The session included three Stimulus Speakers:

In addition, Dan Reitan, CEO, Reincloud gave an Innovation Showcase demo, after which these four were joined on the debate panel by two other industry luminaries:

We’d like to thank the sponsors of the Brainstorm: