|

Summary: Apple is weakening Samsung Electronics’ grip in the high-end of the handset market, lowering the Korean company’s profitability and capacity to compete effectively. After a series of largely unsuccessful attempts to break into software and services, a daring option for Samsung is to seek a strong, strategic alliance with Google to enable both companies to mount a serious challenge to Apple’s dominance in the affluent demographic. Telcos could back such an alliance in return for a profitable role in the service layer. This report analyses the strategic rationale for such an approach. (December 2014, Dealing with Disruption Stream) |

|

Below is an introductory extract and list of contents from this 26 page Report that can be downloaded in full in PDF format by members of the Dealing with Disruption stream here.

(NB. This report is only available to members of our Dealing with Disruption Stream - members of other streams or the Executive Briefing Service please email for more information).

For more on any of these services, please email / call +44 (0) 207 247 5003

In 2013, it looked like Samsung Electronics could challenge Apple’s hegemony at the high-end of the handset market. The Korean giant’s flagship Galaxy smartphones were selling well and were equipped with features, such as large high definition displays and NFC, which Apple’s iPhones lacked.

But in 2014, Samsung’s Galaxy range lost some of is lustre – the latest flagship model, the S5, amounts to a fairly modest evolution of its predecessor, the S4. The Galaxy S5 underwhelmed some reviewers who criticised its look and feel, hefty price tag and erratic fingerprint sensor. Meanwhile, Apple launched two new high-spec handsets - the iPhone 6 and iPhone 6 Plus. These phones markedly close the hardware gap and fill a significant hole in Apple’s portfolio by venturing into the so-called phablet market, which sits between smartphones and tablets. Now that Apple has grasped consumers’ desire for larger form factors and bigger displays, Samsung may struggle to hold on to high-end buyers.

After out-innovating Apple in some respects in recent years, Samsung is now on the back foot again. While Apple is broadly back to parity in terms of hardware, Samsung continues to trail the Californian company in terms of software and services. Most reviewers still regard the iPhone as the gold standard when it comes to user experience.

It is now well understood that the iPhone’s lead is largely down to Apple’s absolute control over hardware and software. Samsung and other vendors selling handsets running Google’s Android operating system have struggled to achieve the slick integration between hardware and software exemplified by Apple’s iPhones. Samsung has often exacerbated this issue by presenting customers with a confusing mix of overlapping Google and Samsung apps on its Galaxy handsets.

In the second quarter of 2014, research firm IDC estimates that Samsung shipped more than 18 million Galaxy S5s, along with nine million S3 and S4 units. That implies Samsung shipped 27 million models in its flagship Galaxy S range, compared with 35 million iPhones distributed by Apple. For the third quarter, IDC didn’t break out Galaxy sales, but the research firm flagged “cooling demand for [Samsung’s] high-end devices,” adding: “Although Samsung has long relied on its high-end devices, its mid-range and low-end models drove volume for the quarter and subsequently drove down average selling prices.”

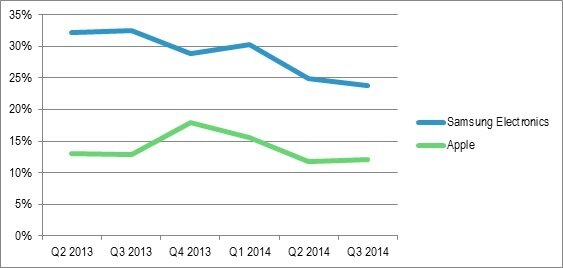

But Samsung can’t afford to cede more of the high end of the market to Apple. The Korean giant is facing increasingly intense competition from low cost Chinese manufacturers in the low end and the mid-range segments of the handset market. The net result has been a marked decline in Samsung’s market share and falling revenues. As the global smartphone market has expanded to serve people in lower income groups, both Samsung and Apple have lost market share to the likes of Xiaomi, Lenovo and Huawei. But Samsung is suffering far more than Apple, whose devices are squarely aimed at the affluent (see Figure 3).

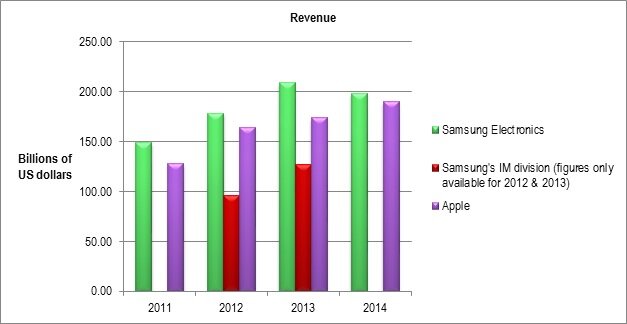

Worse still for Samsung, the decline in average selling prices is hitting its top line, damaging profitability and its ability to realise economies of scale. In terms of revenues, Apple is now almost as large as Samsung Electronics’ three divisions combined and is much bigger than Samsung’s information technology and mobile (IM) division, which competes directly with Apple (see Figure 4).

Source: Financial results, Apple guidance and analyst estimates captured by www.4-traders.com

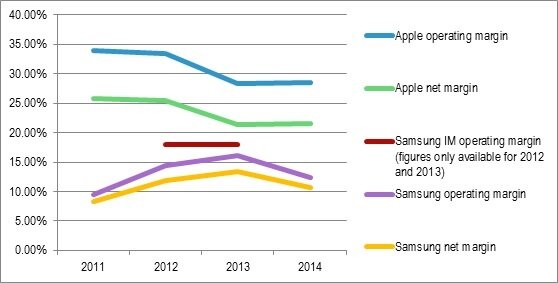

The declining performance of Samsung’s IM division has had a major impact on Samsung Electronics’ profitability. The Korean group’s operating margin is slipping back towards 10%, whereas Apple’s operating margin has stabilised at about 28%, after sliding in 2013, when it faced particularly intense competition from Samsung and the broader Android ecosystem (see Figure 5).

Source: Financial results, Apple guidance and analyst estimates captured by www.4-traders.com

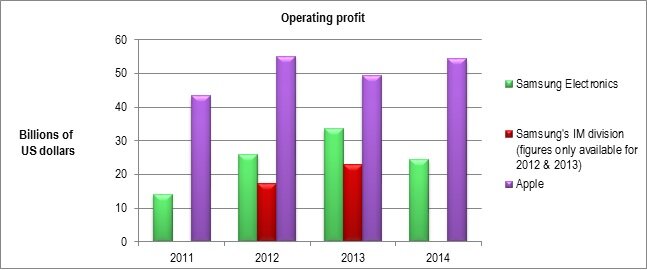

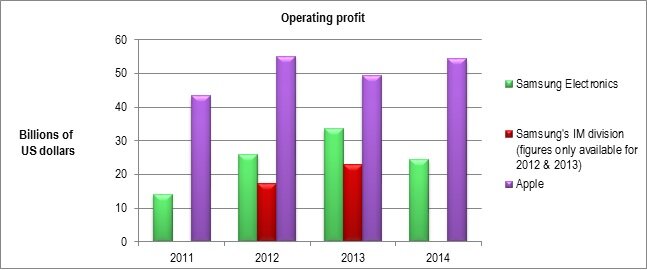

Although Samsung Electronics still generates slightly more revenue than Apple, the U.S. company is likely to make more than double the operating profit of its Korean rival in 2014 (see Figure 6).

Source: Financial results, Apple guidance and analyst estimates captured by www.4-traders.com

Naturally, declining operating profits mean lower net profits and a less attractive proposition for investors. Samsung clearly needs to avoid slipping into a downward spiral where low profitability prevents it from investing in the research and development and the manufacturing capacity it will need to compete effectively with Apple at the high end. Apple is now generating about $20 billion more in net income than Samsung each year, meaning it has far more financial firepower than its main rival, together with a virtual blank cheque from investors (see Figure 7).

Source: Financial results, Apple guidance and analyst estimates captured by www.4-traders.com

Samsung should also be concerned about competition from Microsoft at the high-end of the market. Another company with a surplus of cash, Microsoft has a strong strategic interest in creating compelling smartphones and tablets to shore up its position in the business software market. Now that it is developing both software and hardware in house, Microsoft may yet be able to create smartphones that provide a better user experience than many Android handsets.

In summary, Samsung’s flagging performance in the smartphone market is having a major impact on the financial performance of the group. There could be worse to come. If Samsung concedes more of the premium end of the smartphone market to Apple and possibly Microsoft, it risks competing solely on price in the low and mid segments, where its expertise in display technology and semiconductors won’t enable it to add significant value. Samsung’s margins would erode further and it would be in danger of going into the terminal decline experienced by the likes of Nokia and Motorola, which have also both led the mobile phone market in the past.

An implosion by Samsung would have grave consequences for telcos and their primary suppliers. Aside from Microsoft, the Korean conglomerate is the only company in the smartphone and tablet markets that has the resources to provide credible global competition for Apple. Although the leading Chinese smartphone makers are strong in emerging markets, they lack the brand cachet and the marketing skills to mount a serious challenge to Apple in North America and Western Europe.

To access the rest of this 26 page Disruption Report in full, including...

…and the following figures…

...Members of the Dealing with Disruption Stream can download the full 26 page report in PDF format here. Non-Members, please subscribe here. For other enquiries, please email [email protected] / call +44 (0) 207 247 5003

Technologies and industry terms referenced include:New Digital Economics, smartphones, Internet of Things, smart homes, mobile wallets, localized commerce, location based services, personal data, telco strategy, big data, mobile commerce, digital commerce, APIs, business models, SoLoMo, mobile advertising, mobile marketing, mobile payments.