|

| Digital Transformation 2.0: A summary of the findings of the Digital Transformation session at the New Digital Economics Executive Brainstorm, EMEA, held at the Wyndham Grand Hotel, London, on the 5th June 2013. The Brainstorm covered Digital Transformation Strategies, meeting changing customer needs through disruption, and opportunities in Cloud, SDN and Cybersecurity. (June 2013, Executive Briefing Service, Transformation Stream.) |

|

Part of the New Digital Economics Executive Brainstorm series, the 20th Telco 2.0 event took place at the Wyndham Grand Hotel in London on the 5th and 6th of June, 2013. This report covers the Digital Transformation track on the first day.

Produced and facilitated by business innovation firm STL Partners, the event brought together 180 specially-invited senior executives from across the communications, media, retail, banking and technology sectors, including representatives of:

- Alcatel Lucent, Amazon Web Services, Amdocs, Andorra Telecom, Arieso, Arkessa, BBC Worldwide, Booz & Company, BSkyB, BT, Buongiorno, Cerillion Technologies, Cisco, Connected Homes, Cordys, Deloitte, Deutsche Telekom, du, Ebay, E-Plus, Ericsson, Etisalat, European Commission, Everything Everywhere, Evrythng, GSMA, HP Enterprise Services, Huawei, IBM, IMImobile, MADE Holdings, Magyar Telecom, MasterCard, MEF, MetaSwitch, Minutrade, Mobily, NEC, Network Rail, Next World Capital, Nokia, Openet, Oracle, Orange Digital, Pachube.com, Placecast, Play, Polkomtel, Saatchi & Saatchi, SFR, SumUp Payments, Syniverse, Tekelec, Telefonica Digital, Tesco, Trend Micro, Turkcell, UnboundID, VeriSign, Verizon, Virgin Media, Visa, Western Union, Weve, World Economic Forum, ZangBeZang.

The Brainstorm used STL’s unique ‘Mindshare’, interactive format, including cutting-edge new research, case studies, use cases and a showcase of innovators, structured small group discussion on round-tables, panel debates and instant voting using on-site collaborative technology.

More information: Andrew Collinson, Research Director, STL Partners (www.stlpartners.com)

Email: . Phone: +44 (0) 207 247 5003.

DOWNLOAD REPORT

With thanks to our Sponsors:

Table of Contents:

- Introduction

- Executive Summary

- Session 1: Digital Transformation – Achieving “Industry 20”

- Key themes

- Stimulus Speakers and Panelists:

- Stimulus presentations

- Votes, feedback, and discussions

- Key takeaways

- Session 2: Digital Customers - Where are the sources of value?

- Key themes

- Stimulus Speakers and Panellists

- Stimulus presentations

- Feedback

- Key takeaways

- Session 3: Digital Infrastructure - Cloud, 'Software Defined Networking' and Cybersecurity

- Key Themes

- Stimulus Speakers and Panelists:

- Stimulus presentations

- Key takeaways

- Appendix: Question-Storming Results

- Topic 1: Q-storming: Your Top 3 Questions

- Topic 2: How to create Privacy-as-a-Service?

- About STL Partners

Table of Figures:

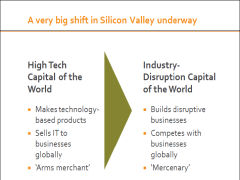

- Figure 1: From technology to business model disruption

- Figure 2: Key characteristics of Silicon Valley?

- Figure 3: The 12-year hunger gap in the music industry

- Figure 4: The record industry consolidated dramatically during the Hunger Gap

- Figure 5: For European telcos, the brutal future is here

- Figure 6: Cost leaders win in commodity markets

- Figure 7: Future sources of growth in the telecoms industry

- Figure 8: The GSMA’s segmentation of the global mobile market

- Figure 9: Revenues have peaked in terms of GDP

- Figure 10: Potential business models: Connectivity, platform, or service?

- Source: GSMAFigure 11: Partnerships between telcos and adjacent players

- Figure 12: Software is the key skill in Telco 2.0

- Figure 13: How Ericsson works with customers to innovate

- Figure 14: How accurate is STL Partners’ forecast for telecoms revenues in 2020?

- Figure 15: How accurate is STL Partners’ forecast of the new sources of value?

- Figure 16: Which of these operators has a compelling plan for growth?

- Figure 17: innovateMobily has generated a high level of participation

- Figure 18: Rate each of these challenges to successful outside-in innovation

- Figure 19: Service providers can struggle to benefit from outside innovation

- Figure 20: Would your company benefit from an innovation scouting service?

- Figure 21: Opportunities to improve the user experience around OTT content

- Figure 22: Virgin Media’s partnership with TiVo

- Figure 23: The differences between TiVo users and other customers

- Figure 24: UnboundID’s arguments in favour of respecting privacy

- Figure 25: Seeking the next S-curve after connectivity

- Figure 26: The potential mobile social data flywheel

- Figure 27: As the cloud improves, the security issues get more complicated

- Figure 28: The cloud requires security to be delegated to individual hosts

- Figure 29: Software-defined networking enables centralised control

- Figure 30: Cisco’s vision for SDN

- Figure 31: The enterprise cloud – maturing and taking on more complex and critical workloads

- Figure 32: What are the biggest barriers to cloud adoption among enterprises?

- Figure 33: What will be the impact of software defined networks?

- Figure 34: A sample of the Telco 20 Transformation Index