Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

| Summary: The transformed mobile web experience, brought about by the adoption of a range of new technologies, is creating a new arena for operators seeking to (re)build their role in the digital marketplace. Operators are potentially well-placed to succeed in this space; they have the requisite assets and capabilities and the desire to grow their digital businesses. This report examines the findings of interviews and a survey conducted amongst key industry players, supplemented by STL Partners’ research and analysis, with the objective of determining the opportunities for operators in the New Mobile Web and the strategies they can implement in order to succeed. (September 2013, Foundation 2.0, Executive Briefing Service.) |

|

This report explores new opportunities for telecom operators (telcos) in Digital, facilitated by the emergence of the “New Mobile Web”. The New Mobile Web is a term we have used to describe the transformed mobile Web experience achieved through advances in technology; HTLM5, faster, cheaper (4G) connectivity, better mobile devices. This paper argues that the New Mobile Web will lead to a shift away from native (Apple & Android) app ecosystems to browser-based consumption of media and services. This shift will create new opportunities for operators seeking to re(build) their digital presence.

STL Partners (Telco 2.0) has undertaken research in this domain through interviews and surveys with operators and other key players in the market. In this report, we present our findings and analysis, as well as providing recommendations for operators.

The emergence of the New Mobile Web is creating a new arena for operators seeking to (re)build their role in the digital marketplace. Many telecoms operators (telcos) are looking to build big “digital” businesses to offset the forecasted decline in their core voice and messaging businesses over the next 5-7 years. Growth in data services and revenues will only partly offset these declines.

In general, despite a lot of effort and noise, telcos have been marginalised from the explosion in mobile Apps and Content, except insofar as it has helped them upgrade customers to smartphones and data-plans. Most notably, there has been a shift in market influence to Google & Apple, and spiralling traffic and signalling loads from easy-to-use interactive apps on smartphones.

Technical developments, including the adoption of HTML5, better mobile devices and faster networks, are transforming the user experience on mobile devices thereby creating a “New Mobile Web”. This New Mobile Web extends beyond “pages”, to content that looks and behaves more like “apps”. By having such “Web-apps” that work across different operating systems and devices – not just phones, but also PCs, TVs and more – the Web may be able to wrest back its role and influence in mobile Apps and Content.

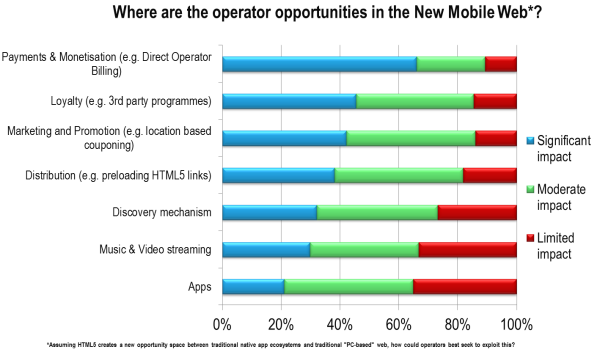

This new digital arena is in turn creating new opportunities to support others; STL’s research found that respondents felt the key opportunities for operators in the New Mobile Web were around: Monetisation, Discovery, Distribution and Loyalty.

Telcos have the requisite assets and capabilities to succeed in this area; they are strong candidates for assisting in monetisation, discovery, distribution and loyalty, especially if they can link in their other capabilities such as billing and customer-knowledge.

This report sets out some of the existing activities and assets that operators should seek to exploit and expand in pursuing their ambitions in the New Mobile Web:

Operators that are aiming to become ‘digital players’ need to adopt coherent strategies that exploit and build on their assets and capabilities. This report identifies 5 broad strategic options that operators should look to pursue and it sets out the rationale for each. These strategies are not necessarily mutually exclusive and can be combined to develop clear direction and focus across the organisation.

Although many operators believe that they urgently need to build strong digital businesses, most are struggling to do so. Telcos are not going to get too many chances to re-engage with customers and carve-out a bigger role for themselves in the digital economy. If it fulfils its promise, the New Mobile Web will disrupt the incumbent mobile Apps and Content value networks. This disruption will provide new opportunities for operators.

The operator community needs to participate in shaping the New Mobile Web and its key enabling technologies. Telcos also need to understand the implications of these technologies at a strategic level – not just something that the Web techies get excited about.

If telcos are not deeply involved – from board level downwards – they risk being overtaken by events, once again. Continued marginalisation from the digital economy will leave operators with the prospect of facing a grim future of endless cost-cutting, commoditisation and consolidation. This should not be inevitable.