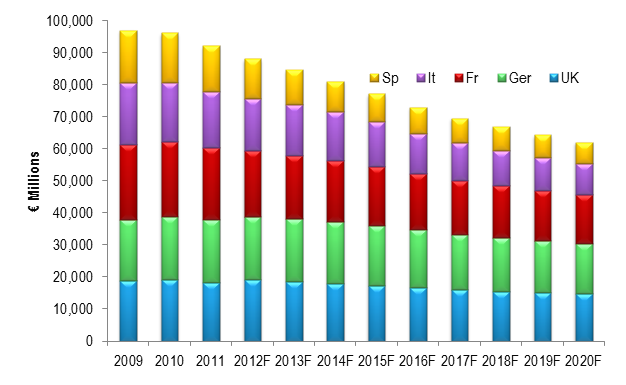

The mobile industry’s combined revenues from voice, messaging and data services in the EU5 economies (UK, France, Germany, Spain and Italy) will drop by nearly €20Bn, or 4% per year, in the next five years, according to a new report published today by the Telco 2.0 Initiative.

This is much bleaker than most current industry forecasts that typically predict a mild decline of c.1-2% per annum.

“It’s like the fable of the ‘Emperor’s new clothes’” says Chris Barraclough, Chief Strategist, Telco 2.0, and report author. “Nobody in the industry wants to say it, but the outlook is very unpleasant.”

The forecast is worst for Spain which is not only suffering from a weak economy, but also has relatively high voice prices compared with other European markets that Telco 2.0 anticipates will reduce substantially going forward.

The core issue, says Barraclough, is that the traditional business model (how telcos make money) is under pressure. “The new competition from Internet-based services, such as Facebook, Apple’s iMessage, WhatsApp and Skype, is making an increasing impact. In essence, users are starting to get cheap calls and new forms of communication from other providers.”

Existing competition, regulation and economic woes compound the pressure, and the new revenue streams, such as mobile data, just aren’t growing fast enough to make up the gap.

“The telecoms industry needs radical change”, Barraclough says. “Cost cutting is important but it can’t solve the industry’s real problem which is that less money is coming in. The industry needs new sources of revenue and profit or will be a very different, and much smaller, beast within five years.”

The industry now needs to innovate as well as manage the core business. “Many of the telcos have started on this path, for example Telefonica Digital, but even they are in the earliest stages of this process. No operator has a well-developed new business models and set of services and, unfortunately, time is not on their side.”

“The good news is that there are opportunities for telcos to create a new future – we call this ‘Telco 2.0’. These opportunities lie in business-to-business services that re-utilise telco assets, including mobile commerce, cloud services, machine-to-machine (M2M), and digital entertainment as well as better business-to-consumer offerings. We’re publishing a lot of new research showing the way ahead in these areas in the next few months” says Barraclough.

Report contact: Chris Barraclough, Chief Strategist & MD, Telco 2.0 / STL Partners.

Contact: +44 (0) 207 247 5003. Email:

https://telco2research.com/articles/EB_European-mobile-future-brutal-telco_Summary

Source: European regulators, Mobile operators, Barclays Capital, STL Partners assumptions and analysis

The 48 page, 33 chart report explores voice, SMS and data volumes and prices to build a ‘bottom-up’ forecast of the five largest European economies. It was based on figures published by European regulators and operators, and proprietary analysis of tariffs and macroeconomic trends.

The report shows that while volumes have held up well in the last few years as prices have declined, the growth of smartphones and data plans has now opened the way for new forms of communication that substitute traditional ones.

“It looks like a perfect storm for telephony services as telecoms operators drop prices in the scramble to increase their market share of a shrinking pool of minutes, texts and megabytes”, added Barraclough.

The report anticipates combined data and SMS revenues to increase by 41% in nominal terms between now and 2020 across the five countries but voice to fall by 77% over the same period.

Established in 2006, the Telco 2.0 Initiative helps drive the transformation of the telecoms industry, looking in particular at new business models and service innovation. It is highly influential on the strategies of the leading players in the market.

The Initiative publishes ongoing research into new business model strategies, and runs regular high level 'executive brainstorms' in 4 continents (Europe, APAC, Middle East, Silicon Valley). These bring senior execs in the telco industry together with their peers in other sectors (banking, advertising, media, retail, etc.) to explore new opportunities for collaborative growth.

Research: https://telco2research.com/

Brainstorms: http://www.newdigitaleconomics.com/events/

The Telco 2.0 Initiative was set up by analyst and consulting firm STL Partners, a specialist research and consulting firm.

“Our focus is on driving transformation through business model innovation in the Telecoms, Media and Technology sector – i.e. how companies make money and grow in turbulent times.”

“Most of the telcos and technology companies around the world subscribe to our research, participate in our brainstorms, and use our consulting services, due to its unique focus and methodologies. We also work closely with the World Economic Forum in the area of ‘personal data’ and have a seat on their global ICT agenda council.”

Simon Torrance, CEO, STL Partners / Telco 2.0

Contact: +44 (0) 207 247 5003. Email: