|

Summary: Facing lockout from a growing chunk of the Internet and mounting competition from the Facebook-Microsoft alliance and Amazon, Google’s core business is under intense pressure. The search giant’s response is to innovate, offering consumers proactive recommendations, as well as reactive search results. Once an interesting sideline, Google Now has become fundamental to the Mountain View company’s future. Is the suggestion service good enough to maintain Google’s position as the world’s leading big data company? (July 2014, Executive Briefing Service, Dealing with Disruption Stream.)

|

|

Below is an extract from this 48 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service and the Dealing with Disruption Stream here.

We'll also be exploring the implications at Digital Asia (2-4 December, Bali), and are initiating coverage of a new research programme on Internet-Driven Disruption, and we'd really appreciate your input here. For more on any of these services, please email / call +44 (0) 207 247 5003

The challenges to Google’s core business

Although Google is the world’s leading search engine by some distance, its pre-eminence is more fragile than its first appears. As Google likes to remind anti-trust authorities, its competitors are just a click away. And its primary competitors are some of the most powerful and well-financed companies in the world – Apple, Amazon, Facebook and Microsoft. As these companies, as well as specialist service providers, accumulate more and more data on consumers, Google’s position as the leading broker of online advertising is under threat in several, inter-related, ways:

- Google’s margins are being squeezed, as competition intensifies. Increasingly experienced web users are using specialist search engines, such as Amazon (shopping), Expedia (travel) and moneysupermarket.com (financial services), or going direct to the sites they need, thereby circumventing Google’s search engine and the advertising brokered by Google. This trend is exacerbated by Google’s ongoing lockout from the vast amount of content being generated by Facebook’s social network. As the Internet matures, general-purpose web search may become yesterday’s business.

- The rise of the app-based Internet: As consumers increasingly access the Internet via mobile devices, they are making greater use of apps and less use of browsers and, by extension, conventional search engines. Apps are popular on mobile devices because they are designed to take the consumer straight to the content they are looking for, rather than requiring them to navigate around the web using small and fiddly on-screen keyboards. Moreover, Apple, the leading provider of smartphones and tablets to the affluent, is seeking to relegate, and where feasible, remove, Google’s apps and services in its ecosystem.

- Android forks: Android, an extraordinarily successful ‘Trojan Horse’ for Google's apps and services, is the market leading operating system for mobile devices, but Google’s control of Android is patchy. Some device makers are integrating their own apps into a forked variant of this open-source platform. Amazon and Nokia are among those who have stripped Google’s search, maps, mail and store apps from their variants of the Android operating system, reducing the data that Google can gather on their customers. At the same time, Samsung, the world's largest handset vendor, is straining at Google’s Android leash.

- Quality dilution: As Google is the world’s dominant search engine, it is the prime target for so-called content farms that produce large volumes of low quality content in an effort to rank highly in Google’s search results and thereby attract traffic and advertising.

- Regulatory scrutiny: Despite a February 2014 settlement with the European Commission concerning its search practices, Google remains in the regulatory spotlight. Competition authorities across the world continue to fret about Google’s market power and its ability to influence what people look at on the Internet.

1. Google’s margin squeeze

Price deflation

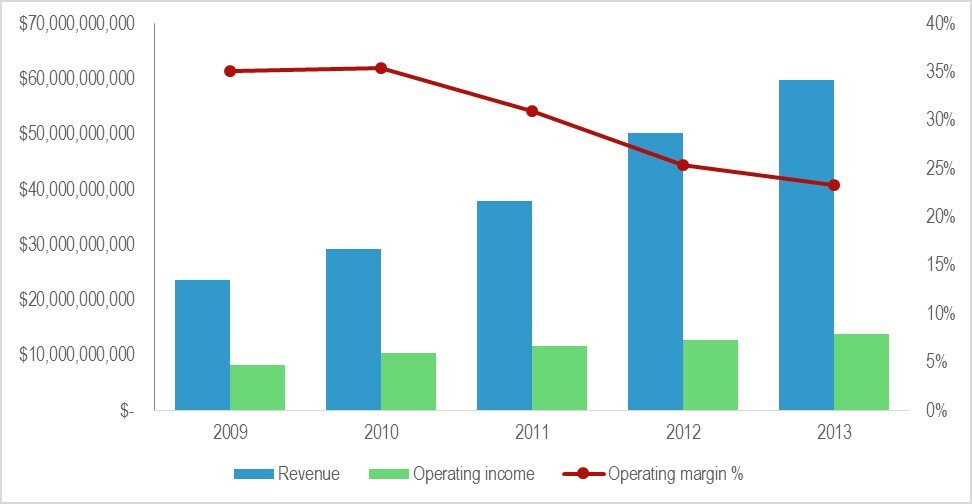

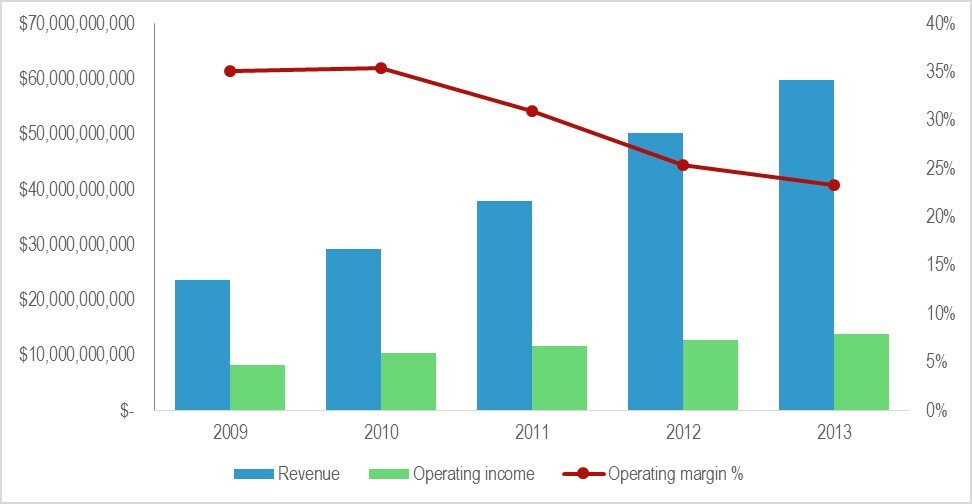

Google, the company that facilitated massive deflation across advertising, content, e-commerce, and mobile operating systems, is itself suffering from the deflationary environment of the Internet. Although revenue and net income are still growing, margins are shrinking (see Figure 2). Google is still growing because it is adding volume. However, there is strong evidence that its pricing power is being eroded.

Figure 2: Google margins are steadily falling as volumes continue to rise

Source: Google filings

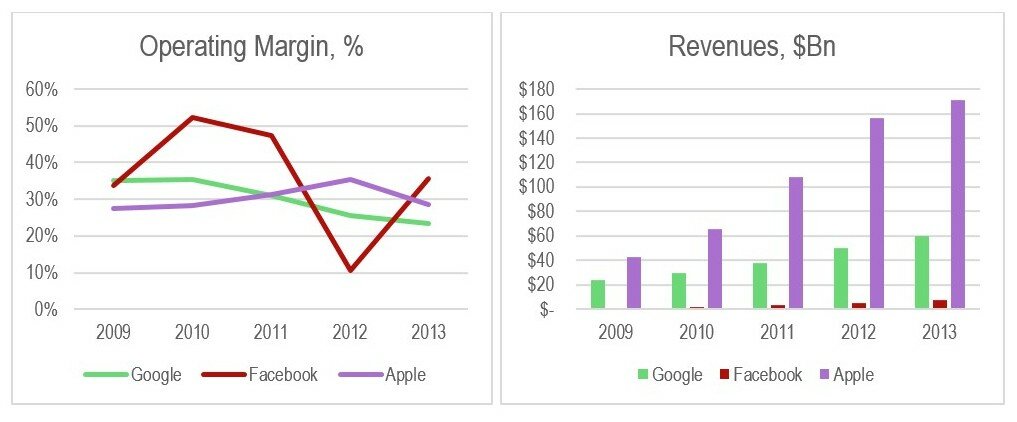

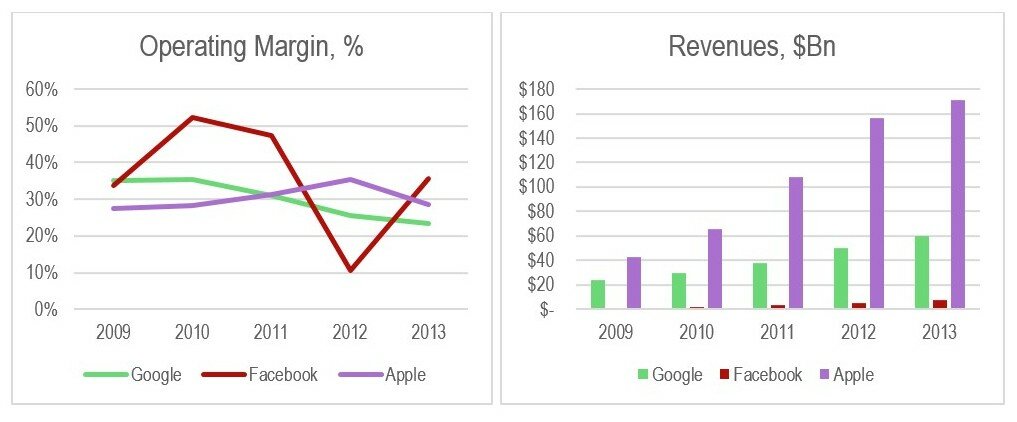

To put this in the context of its Silicon Valley peers, Figure 3 shows the same data for Google, Facebook, and Apple using a trend line covering the 2009 to 2013 period for each company. Note, that we have used a log scale to compare three companies of very different size. Apple saw growth in both revenue and operating margins until 2013, when it hit a difficult patch, although a big product launch might fix that at any time. Facebook has grown revenues enormously, but went through a traumatic 2012 as the shift to mobile hit it. While all this drama went on, Google has grown steadily, while seeing its margins eroded.

Figure 3: Google’s operating margins are now below those of Apple and Facebook

Source: SEC filings

What are the factors behind Google’s declining operating margin? We believe the main drivers are:

- The amount Google can charge per click is falling - buyers get more ads per buck.

- The cost of acquiring ad inventory is increasing.

Cheaper ads

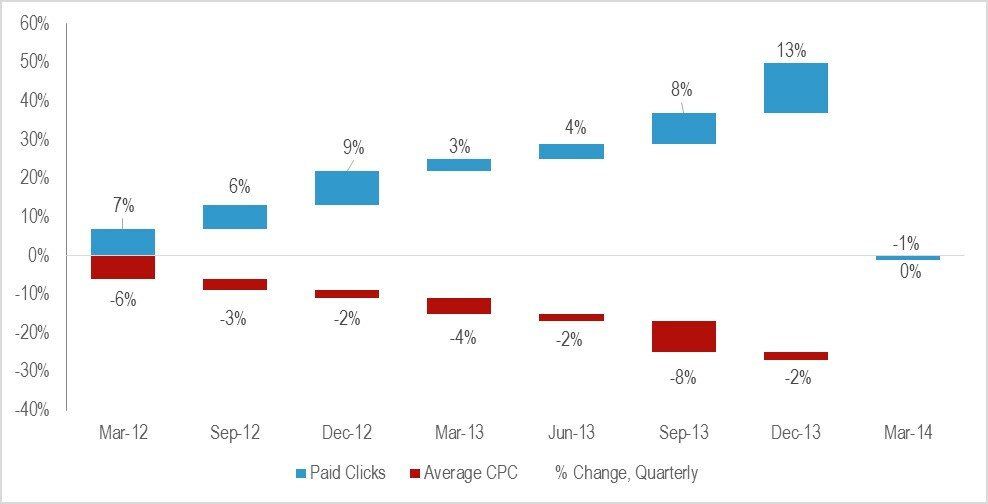

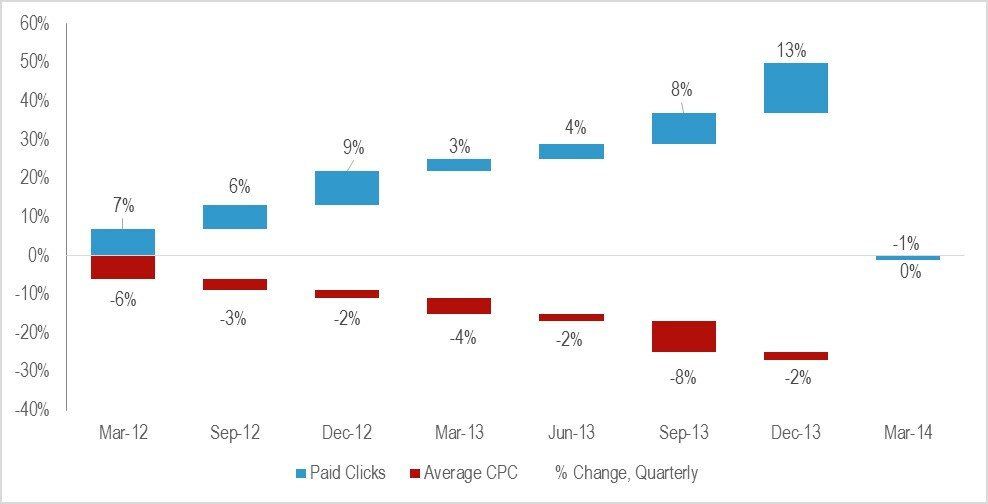

As Figure 4 shows, Google continues to drive ad volume (paid clicks), but ad rates (cost per click) are falling steadily. The average cost-per-click on Google websites and Google Network Members' websites decreased approximately 8% from 2012 to 2013. We think this is primarily due to intensifying competition, particularly from Facebook. However, Google attributes the decline to “various factors, such as the introduction of new products as well as changes in property mix, platform mix and geographical mix, and the general strengthening of the U.S. dollar compared to certain foreign currencies.” The second quarter of 2014 saw paid clicks rise 2% quarter-on-quarter, while the cost per click was flat.

Figure 4: The cost per click is declining in lockstep with rising volume

Source: Google filings

To access the rest of this 48 page Telco 2.0 Report in full, including...

- Introduction

- Executive Summary

- The challenges to Google’s core business

- 1. Google’s margin squeeze

- 2. The rising importance of mobile apps

- 3. Android forks

- 4. Quality dilution

- 5. Regulatory scrutiny

- Google’s strategy – get on the front foot

- Google Now – turning search on its head

- Reactive search becomes more proactive

- Voice input

- Anticipating wearables, connected cars and the Internet of Things

- Searching inside apps

- Evaluating Google Now

- 1. The marketplace

- 2. Develop compelling service offerings

- 3. The value network

- 4. Technology

- 5. Finance - the high-level business modelConclusionsThe problem with recommendationsMake or break? Make

...and the following report figures...

- Figure 1: How Google is neutralising threats and pursuing opportunities

- Figure 2: Google margins are steadily falling as volumes continue to rise

- Figure 3: Google’s operating mar gins are now below those of Apple and Facebook

- Figure 4: The cost per click is declining in lockstep with rising volume

- Figure 5: Rising distribution costs are driving Google’s TAC upwards

- Figure 6: Google’s revenues are increasingly coming from in-house sites and apps

- Figure 7: R&D is the fastest-growing ad-acquisition cost in absolute terms

- Figure 8: Daily active users of Facebook generating content out of Google’s reach

- Figure 9: Google is still the most popular destination on the Internet

- Figure 10: In the U.S., usage of desktop web sites is falling

- Figure 11: Google's declining share of mobile search advertising in the U.S.

- Figure 12: Google’s lead on the mobile web is narrower than on the desktop web

- Figure 13: Top smartphone apps in the U.S. by average unique monthly users

- Figure 14: For Google, its removal from the default iOS Maps app is a major blow

- Figure 15: On Android, Google owns four of the five most used apps in the U.S.

- Figure 16: The resources Google needs to devote to web spam are rising over time

- Figure 17: Google, now genuinely global.

- Figure 18: A gap in the market: Timely proactive recommendations

- Figure 19: Google’s search engine is becoming proactive

- Figure 20: The ongoing evolution of Google Search into a proactive, recommendations service

- Figure 21: The Telco 2.0 Business Model Framework

- Figure 22: Amazon Local asks you to set preferences

- Figure 23: Google Now's cards and the information they use

- Figure 24: Android dominates the global smartphone market

- Figure 25: Samsung has about 30% of the global smartphone market

- Figure 26: Google – not quite the complete Internet company

- Figure 27: Google’s strategic response

...Members of the Telco 2.0 Executive Briefing Subscription Service and the Dealing with Disruption Stream can download the full 48 page report in PDF format here. Non-Members, please subscribe here. For other enquiries, please email / call +44 (0) 207 247 5003.

Technologies and industry terms referenced include: New Digital Economics, mobile wallets, localized commerce, location based services, personal data, Telco 2.0, telecom, strategy, strategies, disruption, innovation, transformation, big data, Microsoft, Google, facebook, mobile commerce, digital commerce, APIs, business models, SoLoMo, mobile advertising, mobile marketing, mobile payments.