Understand investors’ appetite for risk

Before developing a new and disruptive product or service or value proposition whether in a start-up or within an established business, management need to understand the appetite for risk that investors has for investment and risk. For those in larger organisations, the ‘investor’ is usually played by a line manager or CFO but the principles remain the same. There is no point in proposing or developing a concept for a service which requires massive capital investment and has huge implementation risk if investors will not support this.

Match your disruptive action your investors’ risk profile

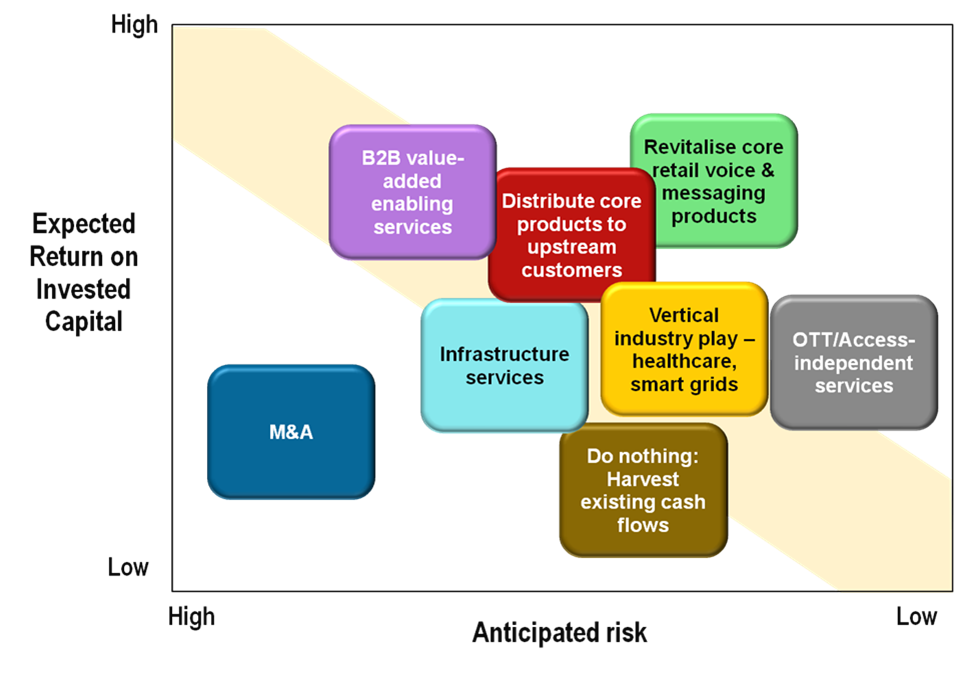

Assess investors’ appetite for risk and then seek solutions that give the highest expected return on invested capital within acceptable levels of risk. Figure 1, below, illustrates the relationship between risk and return (with a normative band in yellow) and the differences in eight strategies. Six of these map on to the standard ‘Telco 2.0’ opportunity areas (outlined in the forthcoming Telco 2.0 strategy report, The Roadmap to Telco 2.0, and summarised in the Appendix to this report) and two, M&A and ‘Do Nothing’ have been added for a more complete picture.

M&A will always be high risk...

At one extreme, empirical evidence suggests that M&A, whether it is within your own industry or market or into another industry or geography, is a very high-risk strategy and one that usually results in a low (or negative) return. Many Telcos themselves have been victims of ‘exuberant’ M&A behaviour and have had to make substantial write-downs on acquisitions. Essentially, they have determined that they paid too much for their acquisitions.

...whereas an access-independent (OTT) service is relatively low risk

At the other end of the risk spectrum is launching an OTT service (one that is independent of an operator’s own access network). The main concern is that a competitor could respond with something similar that affects your own network-based services. For example, if all operators launched OTT VoIP services on each others’ networks the value of all their core voice business would be damaged significantly. This is relatively unlikely owing to concerns about such cannibalisation. Coupled to this, the launching of an OTT service is unlikely to require huge capital or damage the core business if it fails. Such an OTT service is, however, unlikely to generate massive returns – most services are unlikely to move the needle and most operators would need to consider several and hope that one or two ‘make it big’.

Figure 1: Risk/reward profile of Telco operator generic disruptive options

Source: STL Partners/Telco 2.0

Note: See Appendix for definitions.

Focus on areas that could yield strong returns

It remains our belief that focusing on improving core products and services, such as voice and messaging, could yield above average returns and give a good bang for the buck. Operators have historically been very poor in this area – voice has changed little in the last twenty years with most innovation coming from software and hardware players making it easier to use voice via directory services and better user interfaces. It is here, for example, that both Apple and Facebook are (in very different ways) establishing a strong foothold in communications. Much greater effort should be placed on voice and messaging and on developing stronger software and web integration skills that will help to protect (or even grow) these services which otherwise face inevitable continued decline.

The risks associated with each operator/player will be different

We mentioned the risk of cannibalisation earlier. This is really an issue only for established incumbents with an existing product or service to cannibalise. This moves us on to a wider issue: that of different risk profiles for different players. Smaller players and start-ups tend to have ‘less to lose’ than established organisations which, in addition to cannibalisation, are often cautious about innovation owing to potential issues such as:

Bigger players can take a portfolio approach

One of the benefits of being an incumbent, which perhaps mitigates some of the risks outlined above, is that incumbents have the scale (and sometimes skills) to pursue a portfolio approach. They can invest in developing services across most of the Telco 2.0 categories rather than being forced to focus on placing a winning bet in only one or two areas. Having several projects with different risk profiles running concurrently is, in itself, is a risk-reduction strategy as failures in one area can be offset by successes elsewhere.

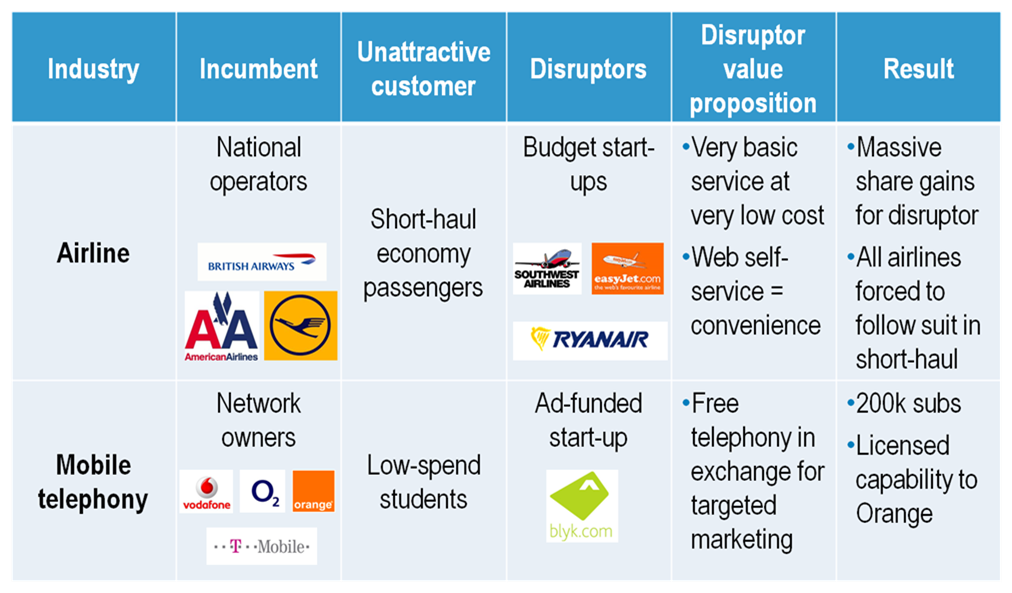

Most competitors focus on the most valuable customers

The most attractive customers in the Telecoms industry – business professionals and early adopters – naturally attract most attention from operators as they generate big returns and often encourage other customers to adopt products and services. The downside with focusing on such customers is that it tends to ossify current solutions and existing business models. What has worked in the past becomes the basis for what will work in the future. This leaves operators vulnerable to disruptions that ‘change the rules’.

One way to prevent this and to force management to consider disruptive behaviour before a competitor engages in it, is to consider what needs to be done to produce a profitable value proposition for traditionally unattractive customers. We do not mean customers that are in inherently ‘bad’, such as the criminal fraternity, but customers that cannot be served profitably using the traditional operational and business model.

Airline industry experience suggests focusing on unattractive customers can be very disruptive

In the 1970s’ and 1980s’ air travel was very expensive. Airlines focused particularly on creating a high-quality experience for business travellers on long-haul flights where margins were the highest. There was a culture of luxury and opulence. South West Airlines in the US and then a rash of players in Europe, led by Ryanair, changed this. Their focus was the economy passenger on short-haul flights – the least attractive customer for the major airlines. By focusing on cheaper ‘out of town’ airports and doing away with the ‘bells and whistles’, they opened up short-haul air travel to the masses and vastly increased passenger volumes. Increasingly, all customers (including corporate ones) decided they did not need the 5-star treatment on short-haul flights and the big airlines were forced to follow suit and reduce their costs (and the quality of the service).

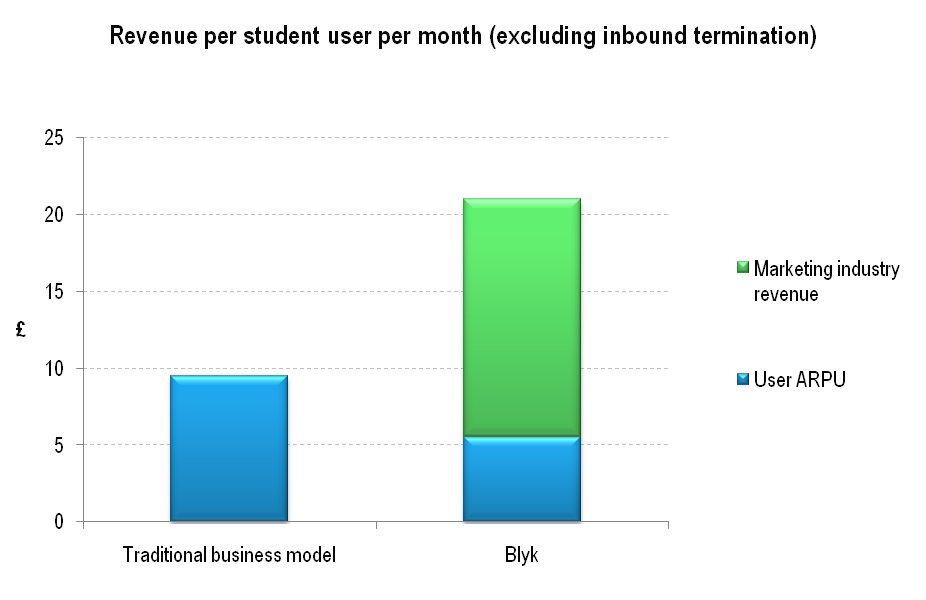

While by no means as successful in telecoms, Blyk has instigated something similar in mobile telecoms. Operators in the UK are no different to other markets in their focus on high-spending business customers and which they shower with subsidised expensive handsets. The student market has always been considered in ambivalent terms: some are tomorrow’s ‘Captains of Industry’ but most have no money and therefore generate low ARPUs and margins. Historically, they have been largely ignored and expected to pick up a low-end device on a Pay-as-you-go deal.

It was these customers that Blyk targeted by offering them a bundle of free voice and messaging in return for receiving targeted marketing messages (via SMS and MMS). Such an approach had been considered by other players but had never gained credence for the principle reason that giving away voice and messaging was counter-intuitive to most managers. They saw no point in cannibalising existing revenues from end-users only to try and replace them with uncertain advertising revenues from others. Such an approach had the added disadvantage of potentially eroding the perceived value of their core voice product.

The results of Blyk’s approach were very interesting. On the positive side:

Blyk faced other problems which limited its success as a standalone MVNO in the marketplace which we have covered a length elsewhere on our blog and in our subscription service, including:

Blyk ultimately decided to license its platform to Orange in the UK which now uses its technology and media relationships to offer a similar concept to its student customers via its Orange Shots service. Many have thus called Blyk a failure. Telco 2.0 thinks this is fundamentally wrong. Blyk’s MVNO approach was probably the only credible market entry strategy available. It would never have achieved a licensing deal with any UK operator until the concept had been proven. By gaining 200,000 customers in less than two years, very strong response rates and an attractive operational and business model, it convinced Orange that such a strategy was viable and there was value in such low-end customers. Indeed, now Orange has merged with T-Mobile in the UK, the combined entity probably has a reach of around 6 million 16-24 year old customers (Blyk’s target market), making the audience much more attractive to marketers should the concept be rolled out to T-Mobile customers too.

Figure 3: Blyk’s operational and business model is fundamentally attractive

Source: STL Partners/Telco 2.0 estimates

To read the rest of the report, covering...and including...

Figure 1: Risk/reward profile of Telco operator generic disruptive options

Figure 2: Focusing on ‘unattractive’ customers forces a disruptive approach

Figure 3: Blyk’s operational and business model is fundamentally attractive

Figure 4: Real Networks – struggling to make money against freebie services

Figure 5: What happens if competitors offer Telco products and services for nothing?

Figure 6: Picking where to collaborate with other operators is important

Figure 7: Collaboration outside Telecoms increasingly important as ecosystem becomes more complex

Figure 8: Value (in the value network) + control (exerted by company) determines business model health

Figure 9: Nokia Communicator – an example of cramming everything in

Figure 10: Mobile telephony outperforms fixed in only three areas

Figure 11: QoE perspective is much wider than network QoS

Figure 12: Skype QoE dashboard

Figure 13: Focus on the main business model drivers early in the development process

Figure 14: Skype allows customers to use the service for free and is then paid on around 8% of voice minutes

Figure 15: STL Partners/Telco 2.0 has a freemium model and a pathway to higher value products

Figure 16: The importance of cost reduction in disrupted industries – The US Steel Industry

Figure 17: R&D spend inside and outside Telecoms

Figure 18: Centralised vs decentralised R&D

Figure 19: Some Google product and service ‘failures’

Figure 20: STL Partners’ Telco 2.0 growth opportunity areas for operators

...Members of the Telco 2.0TM Executive Briefing Subscription Service can read the Executive Summary and download the full 47 page report in PDF format here. Non-Members, please see here for how to subscribe. Please email or call +44 (0) 207 247 5003 for further details.