|

| Summary: At the Digital Arabia Executive Brainstorm in Dubai, November 2012, we found that the region is on the edge of an exciting period of growth in digital commerce, entertainment and public sector services, enabled by mobile in particular. However, success depends on telcos and others working together effectively to put key enabling digital platforms in place, and this is not yet happening fast enough to avoid the stagnation now seen in many Western markets. How can this be changed? (November 2012) |

|

Below is a preview of the Executive Summary of the detailed report from Digital Arabia 2012. The full report is available to download below in PDF format to event participants and members of the Telco 2.0 Executive Briefing service. Non-members can subscribe here. To find out more and for all other enquiries, please email / call +44 (0) 207 247 5003. We'll also be discussing our findings at Digital Asia - the New Digital Economics Brainstorm in Singapore (3-5 December 2012) and at future brainstorms.

To share this article easily, please click:

Introduction

Digital Arabia took place on 5-7 November, 2012, at the Jumeirah Creekside Hotel, Dubai.

DOWNLOAD REPORT

Part of the New Digital Economics Executive Brainstorm & Innovation Series, it built on output from recent events in San Francisco, Singapore, London, New York and new market research and analysis, and focused on new business models and growth opportunities in digital commerce, content and the cloud in the Middle East and North Africa.

Produced and facilitated by business innovation firm STL Partners, the event brought together 160 specially-invited senior executives from across the communications, media, retail, banking and technology sectors, including: Adline Media Network, Aegis Media, Aepona, Aflamnah, Al Ansari Exchange, Al Futtaim, Anayou, Anghami, Barwa Bank, Batelco, BPG Group, BPG Maxus, STC, Capgemini Consulting, Chalhoub, Choueiri Group, CSG International, du, Dubai Airports, EMS, Ericsson, Etisalat, Eyelevel Interactive, Flip Media, General Motors, GETMO, Huawei, Hungama, Image Nation, iMENA, IMImobile, Intigral, Istikana, Kraft Foods, Mastercard, MBC Group, MEFMobile, Millicom, Mobily, MTN, Nazara Technologies, Nokia, Noor Islamic Bank, OSN, Proctor & Gamble, QANAWAT, Qtel, Rolandberger, Telefonica Digital, Touch, Turner, UnboundID, Unilever, Universal Music Group, Visa, Vuclip, Walt Disney, Zain Jordan, and ZapFi.

The Brainstorm used STL’s unique ‘Mindshare’ interactive format, including cutting-edge new research, case studies, use cases and a showcase of innovators, structured small group discussion on round-tables, panel debates and instant voting using on-site collaborative technology.

We would like to thank the event sponsors:

This note summarises the key themes emerging from the Brainstorm.

Executive Summary

The Arabic world is on the cusp of realising heightened creativity and progress in commerce, entertainment and public sector services. Success depends on telcos and others working together effectively to put key enabling digital platforms in place, and this is not yet happening fast enough.

Key points arising at the Digital Arabia event (and analysed in the body of the report) were:

- The shift to digital changes everything for telecoms operators and other service providers – vision, goals, governance, business models, customer experience, business processes, and operations are all set to transform with the growth of the digital economy.

- There is still a strong sense of confidence in the existing business model practices from MENA executives – are they complacent? Participants were significantly more optimistic that core services revenues can be maintained or, indeed, grown than their European peers. While STL Partners agrees that the market will keep growing in the near-term, it seems that the industry is being overly optimistic. Many Western telcos had similar views three years ago, were then taken by surprise by the speed of decline, and did not put new platform business models in place early enough. We therefore think that there is a real danger that MENA telcos are repeating the mistake of not acting decisively and quickly enough.

- Digital platforms need scale to succeed – the biggest, best quality platforms (digital marketplaces) deliver the best returns. To create them will require appropriate collaboration between telcos.

Figure 1 – Innovation strategy: collaborate or go it alone?

Source: Participant Vote, Digital Arabia Brainstorm, Nov 2012

Arabia’s underserved digital market is hungry for new digital services, and services that enable new activities or ease the problems of the physical world.

- There is significant scope for innovation in 'Digital Arabia' in digital commerce platforms, data centres, and media and entertainment formats and delivery.

- Mobile is the 'first screen' in Arabia now, with Mobile IP traffic growing hugely and mobile access being near ubiquitous to the population. Although standard forms of mobile advertising are not working, where innovative approaches that integrate the relative strengths of mobile and interactive media are used, broadcasters, advertisers and brands alike have been delighted with the results. Major advertisers and brand owners now need significant improvements to give more comprehensive and structured access to mobile assets and media opportunities in their many forms.

- The importance of personal data and ‘Big Data’ for operators is growing. The brainstorm explored case studies, best practice, and a new framework to categorise five types of opportunities for operators.

Figure 2 – The value of telco capabilities to retailers

Source: Participant Vote, Digital Arabia Brainstorm, Nov 2012

- Digital Commerce 2.0: digitising cash and loyalty, and enabling new propositions are the priorities particularly in mobile commerce, where the principle value creation mechanism is the exchange of information for value (rather than taking a cut and imposing friction on tiny transactions). The UAE, Qatar and Saudi Arabia are relatively well-positioned in mobile payments readiness.

- Digital Entertainment 2.0: bridges must be built between telcos and entertainment companies to enable the co-evolution of both industries future business models in the region.

- Telcos must work together to achieve sufficient scale in new platforms. We believe that to succeed to the maximum extent, telcos need to create market-wide, multi-telco platforms in key areas, or local or global aggregators (e.g. Google, Apple, etc.) will take this valuable role in the digital economy.

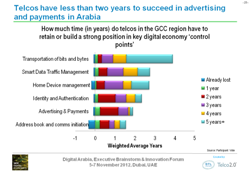

Figure 3 – How long do telcos have to retain or build a strong position?

Source: Participant Vote, Digital Arabia Brainstorm, Nov 2012

- F’ is for ‘Fast’. The opportunity will not last long and telcos must act now to achieve it. Given the relatively favourable circumstances in the region, and the cautionary example of how much western telcos have lost through prevarication and avoidance, MENA telco leaders should not lose the opportunity to stay strategically relevant in the next phase of the evolution of the digital economy.

- It’s hard…but possible, and requires industry leaders to take big decisions to overcome the “prisoners’ dilemma” of when and where to work together. They also need to overcome ‘softer’ but no less challenging issues rooted in established organisational cultures and corporate identities in order to partner with traditional competitors and create new markets based on “co-opetition”.

Next Steps for STL Partners

We will of course work to support the industry to help overcome these issues where we can. We will also be:

- Working with the output of the brainstorm to communicate further findings in detailed areas such as Enterprise Cloud;

- Planning the next Digital Arabia Executive Brainstorm with the support and feedback from the 2012 participants, who we would like to thank again for their excellent contributions.