Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

Summary: Telco 2.0’s analysis of Facebook’s business model shows that the social networking giant may need to turn to communications for much needed new revenues.

This article is an extract from Telco 2.0’s new Executive Briefing Report titled ‘Facing up to Facebook’ published here. We’ll be sharing more of this analysis online at Best Practice Live! on 2-3 Feb 2011, and there will be more on this and related topics in our adjacent player research stream and Telco 2.0 Executive Brainstorms.

Facebook – Goliath of Social NetworksFacebook is now the second highest ranking website globally behind Google, according to Alexa. In the UK it accounts for over half of all web pages downloaded on mobile. It is the de facto communications tool of choice for young people and is becoming increasingly popular among older generations and businesses.

Our new analysis looks at how Facebook’s business model and service offering will develop going forward, to what extent the company will be a partner to the Telecoms industry versus a competitor, and what strategies telcos need to employ in dealing with it? It builds on a similar analysis we did on Google, which has proved extremely popular with our subscribers.

We’ve previously outlined some of the the industry context in Facebook: a voice & messaging competitor?, described a parallel market development in China’s Monster ‘Facebook’ QQ: coming to a screen near you, and started to describe the emergence of the ‘Personal Information Economy’ in Facebook, Google, Apple: User Data, Apps, and Augmented Reality.

Facebook and telcos have a strained relationship. While telcos benefit from Facebook’s ability to create broadband pull and Facebook benefits from operators’ powers of distribution, both have communications at the heart of their business model. Telephony is largely synchronous Peer-to-Peer (P2P) communication, paid for by the end user; social networking is largely asynchronous group communication, free to the end user and funded by advertisers.

It is the strength and popularity of this free (or freemium) business model that could de-stabilise core operator voice and messaging revenues. This threat was brought into sharp relief recently by reports of a possible deal with Skype.

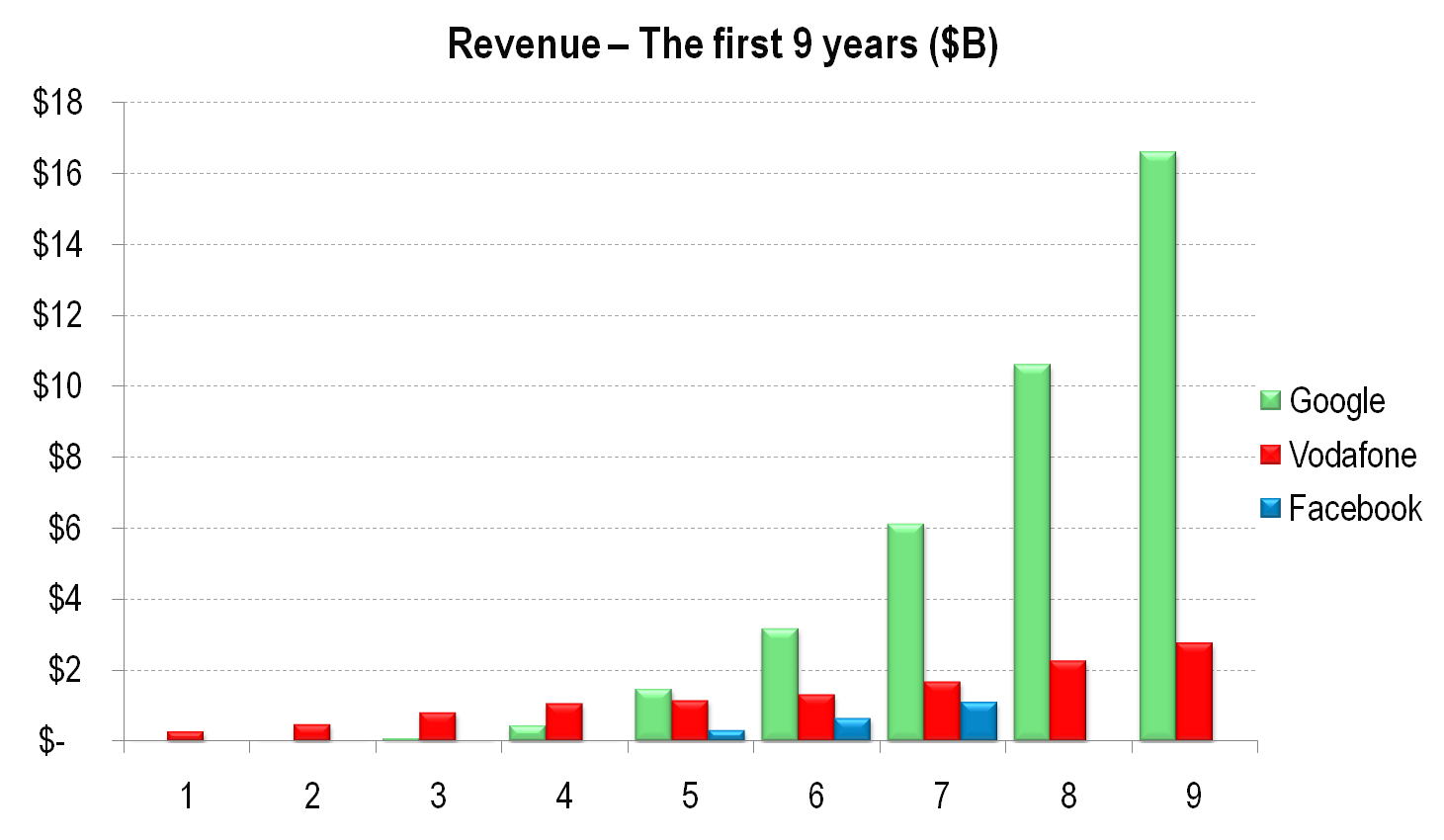

Having said this, Facebook certainly faces challenges in extracting sufficient value from advertising and will need to find other ways of collecting revenues from its user base. The following chart compares the revenue growth profiles of Google, Vodafone and Facebook since each started, and shows that Facebook has not yet achieved anything like Google’s revenue success.

Figure 1 – Revenue: no sign of the ’Google Surge’ yet…

Source of all images: Telco 2.0 – ‘Facing up to Facebook’

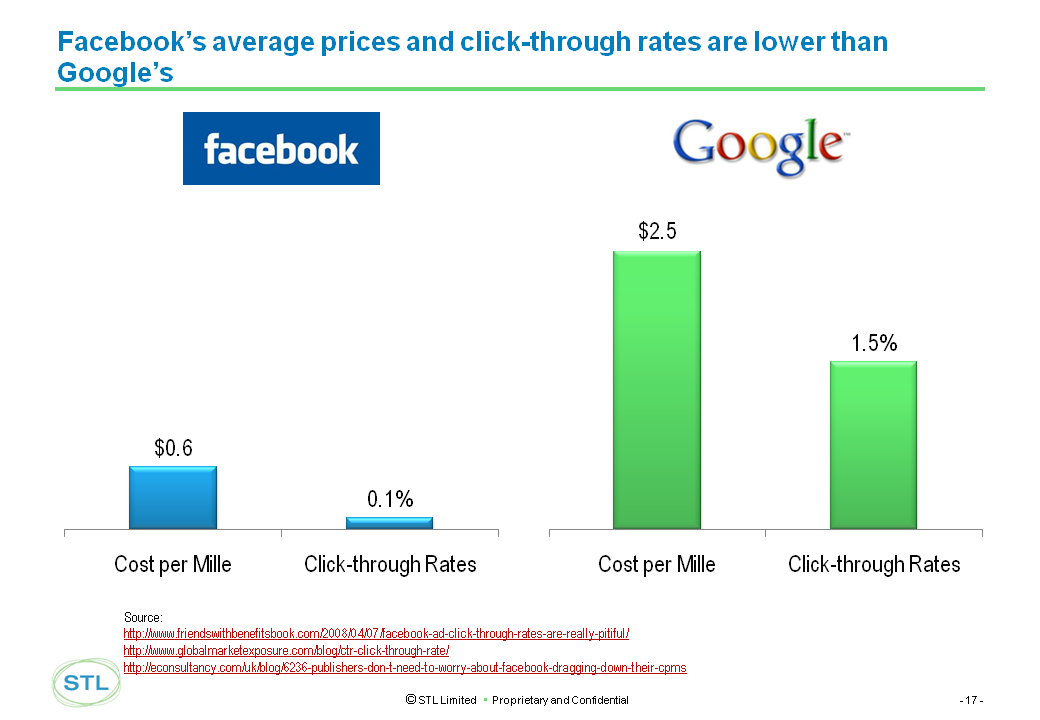

Our analysis also shows that some of Facebook’s key operational KPIs are significantly lower than Google’s.

Figure 2 – Facebook Vs Google, Click-Through and Revenue Rates

The management of users’ contacts and privacy is an increasingly important component of capturing user attention and communications-related revenue. Facebook has built a sophisticated directory and privacy service, although has attracted some negative attention regarding the latter in recent months. This is another area of potential future competition between Facebook and Telcos, as telcos start to think seriously about exploiting the strategic value of their consumers’ data as we describe in Can Telcos Unlock the Value of their Consumer Data?

Yet despite the enormous usage, publicity and potential of Facebook, market valuations seem irrationally high.

Figure 3 - Facebook $ Revenue / User Vs $ Value / User

Source: Telco 2.0 - 'Facing up to Facebook'

This means that each $1 of revenue is valued nearly five times as highly as a $1 of Google's! It is therefore clear that Facebook will be compelled to find new sources of growth.

Figure 4 - $ Value / User, Facebook Vs Google

Operators have opportunities individually and collectively to partner and compete with Facebook but must better understand the company’s strategy and strengths and weaknesses to do this effectively.

In the upcoming Executive Briefing and at the Telco 2.0 Autumn events we’ll be exploring:

Presenting at the Brainstorms will be Chris Barraclough, Managing Director & Chief Strategist, Telco 2.0 Initiative, and lead author of ‘Facing up to Facebook’. Hans Frederick, VP Marketing Solutions, ComScore, and Jennifer Byrne, Director, Business Devt, Verizon Wireless, will be joining Chris as a speaker and panellist respectively at the Americas Brainstorm.

In the meantime, for more information, watch this space or email .