|

Summary: Netflix’s success in the US and in Western Europe has demonstrated that consumers are willing to change how they watch and pay for TV and movies. As a result Netflix’s OTT proposition is challenging traditional pay TV models and changing how new broadband services are looking at content. For some players Netflix is a threat and for others an opportunity. So, how should content owners, channels, pay platforms and broadband providers respond? (February 2015 UPDATE, Executive Briefing Service, Dealing with Disruption Stream.) |

|

Below is an extract from the 33 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing Service and Dealing with Disruption Stream here. STL Partners has partnered with Prospero Strategy Consultants in the production of this report.

For more on any of these services, please email / call +44 (0) 207 247 5003

Since our last report on Netflix in November 2014 the market and Netflix have moved rapidly. Netflix subscriber numbers grew by 4 million globally in the last quarter, it increased its number of markets from 41 to 50 and saw US penetration rise from 31% to 34%. However, the most significant change has been Netflix’s announcement of its plans to expand into 200 countries by the end of 2017. This is a highly ambitious plan which would make Netflix a truly global player, potentially able to acquire content across the world, remove geo-blocking (or define the service by language) and changing its ability to compete with incumbent national players for core rights.

The way in which audiences consume movies and television content appears to be changing. While ‘linear’ viewing of scheduled channels remains robust, the market for DVD has collapsed and new pricing and consumption models are opening up.

At the forefront of this is Netflix – with a total of 63M paying subscribers across 50 markets (it is present in a large number of locations in Latin America and the Caribbean) and a penetration of over 34% in the US, Netflix has created a new paradigm for on demand content.

How this model is going to impact other players in the market in the long term is as yet unclear. To date in the US, pay platform penetration has remained robust, premium channels such as HBO are also performing strongly, and for rights owners and producers a new player bidding for rights is hugely welcome.

So is Netflix a ‘win: win’ opportunity for all concerned? It may not be that straightforward.

STL Partners has partnered with Prospero Strategy Consultants who work extensively with content and platform players on new market dynamics to prepare this Briefing. The work has drawn on interviews with key players and analysis of quantitative and qualitative market data, to determine the threats and opportunities emerging from this new content ecosystem and how these are likely to develop.

Overview of Netflix

History

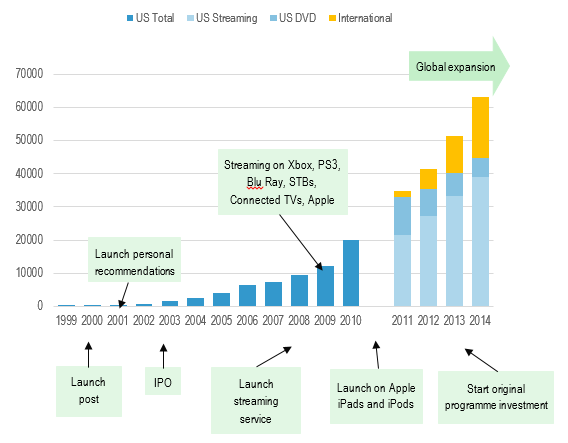

Netflix began as a postal DVD business in the US in 1997, launching its US subscription streaming service in 2007. Since 2011 it has focused on rapid expansion into international markets with the biggest growth now coming from international subscribers (67% growth between 2013 and 2014) while its US DVD business is now in decline.

Figure 4: Netflix subscribers 1999 – 2014(Q3) in 000s

The success of the Netflix proposition to consumers has been based on a number of components:

Low Price and refusal to tie users into long-term contracts

Volume and exclusivity of content

Effective User Interface, recommendation engine and multi-device access

Customer Data

Low Price

The low monthly price point of Netflix (USD7.99 per month in the US rising to USD8.99 for new subscribers in 2014) has been a key component of the company’s success. This price point is less than the cost of purchasing a single DVD and significantly less than monthly premium drama channels such as HBO (at ~USD15 per month). This price point (and that users are not tied into long term contracts) allows Netflix to attract distinct audience groups.

First, the high-end audience who are already pay subscribers. These customers have demonstrated that they are typically price inelastic and willing to pay for more, buying Netflix on top of existing services.

Second, the price constrained audiences, for whom traditional pay TV is out of reach but who are interested in expanded choice. These are often younger demographics for whom the concept of non-linear consumption is very familiar.

There is a third audience group, the price sensitive pay TV subscribers for whom Netflix could be an effective substitute and who could churn off traditional pay TV (either completely or partially) as a result. While the evidence around the impact on this group is as yet nascent, it is this segment that is making incumbent pay TV players nervous.

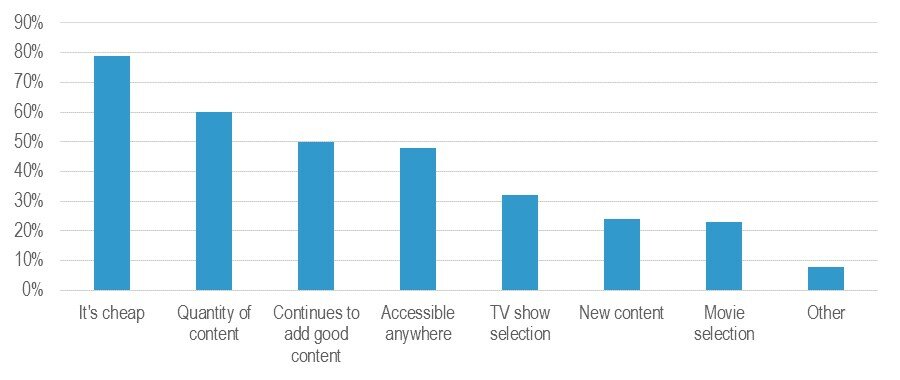

Source: Alphawise, 3rd Annual Streaming Video Survey – More Devices, More Consumption, March 2013

Volume and Exclusivity

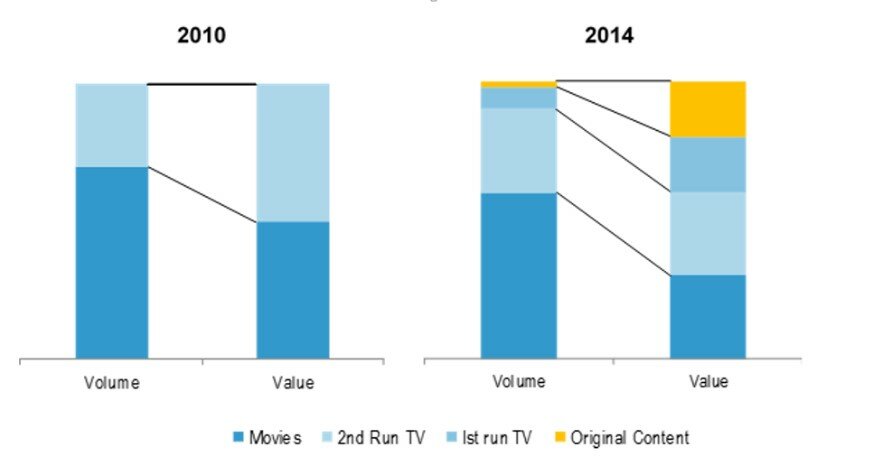

As demonstrated in Figure 5 above a key to success has been offering both range and quality of content. However, over time the shape of the Netflix library has changed as it has used its customer insight and data to inform its rights strategy.

In February 2012 the Netflix US library consisted of ~15k titles (Source: SNL Kagan) of which nearly three quarters were movie titles.

Since 2012 the volume of library titles has declined by approximately 30% nearly all of which is accounted for by a decline in movie titles. Netflix has increased its focus on long run drama series which already have brand recognition and which are effective at attracting and keeping audiences.

Interestingly, the volume of content being offered in its international markets is significantly less than in the US (about one-third) as Netflix shifts its focus to quality (as opposed to quantity of content)

Netflix’s early content deals were typically library rights and non-exclusive. Over time that mix has shifted as Netflix increasingly looks to have a component of exclusivity with the aim of shifting from a “nice to have” to a “must have” service

Netflix is investing in original production of a limited number of high profile, high end drama series (such as House of Cards, Orange is the only Black and the recently announced Crouching Tiger Hidden Dragon sequel). For these Netflix can retain its exclusive rights indefinitely.

In addition, Netflix is bidding aggressively for exclusive windows for high end content (such as the recently announced deal for exclusive VOD rights in all territories for Gotham and first window rights in several territories for Penny Dreadful).

Source: STL Partners & Prospero analysis

Effective consumer interface on multiple devices

Netflix has evolved a highly effective consumer interface, enabling personalisation by individual members in the household, with an easy to manage and visually effective selection mechanism.

Source: Netflix & SNL Kagan

Customer Data

Netflix continues to refine its customer understanding using sophisticated A/B testing where small sub groups are given slightly different user experiences to see how this changes behaviour

To access the rest of this 33 page Telco 2.0 Report in full, including...

Executive Summary

Introduction

Overview of Netflix

History

Consumer Proposition and USPs

Netflix International Expansion

Netflix Financials

Attitude of the Financial Markets

Impact of Netflix on the Market

Impact on Rights Owners and Producers

Impact on Channels

Impact on Pay Platforms

Impact on Broadband Operators

Summary impacts on players along the value chain

Responses to Netflix

Case Study: HBO

Case Study: BSkyB

Case Study: Broadband Operators

Case Study: New Competitors

...and the following report figures...

Figure 1: Selected Media Companies Market Capitalisation, 1st Sept. 2014 (left) & 1st Jan. 2015 (right), USD billion

Figure 2: Netflix’s subscriber targets for 2020 (announced launches only) in USD million

Figure 3: Summary of Netflix’s Impacts along the Value Chain

Figure 4: Netflix subscribers 1999 – 2014 in 000s

Figure 5: Reasons Netflix streamers subscribe to the Service

Figure 6: Netflix’s Evolving Content Proposition

Figure 7: Netflix’s user interface

Figure 8: Netflix geography and timeline

Figure 9: Netflix’s Market Penetration over time to Dec 2013 (% households)

Figure 10: Netflix revenue per service area, 1999 - 2014, USD million

Figure 11: Netflix’s revenues & costs per business line, 2011–2014, USD million

Figure 12: Netflix’s net income and free cash flow, 2009 – 2014, USD million

Figure 13: Netflix’s streaming content obligations, 2010 – 2013, USD million

Figure 14: Selected Media Companies Market Capitalisation, 1st Sept. 2014 (left) & 1st Jan. 2015 (right), USD billion

Table 1: Comparison of Key Value Ratios

Figure 15: Netflix’s share price (USD), Jan 2010 – Jan 2015

Figure 16: Players along the Value Chain

Figure 17: Subscribers to premium channels in the US (%of TV households)

Figure 18: Changes in US Pay TV Penetration

Figure 19: Percentage of Households that are “cord-cutters”

Figure 20: Real Time Entertainment Share of Downstream Traffic

Figure 21: Share of Traffic of Downstream Peak Time Applications

Figure 22: Summary of Impacts along the Value Chain

Figure 23: Overview of Sky Expanded Offering

Figure 24: Sky’s offering across All Windows

Figure 25: Vodafone / Spotify and Sky Sport deals – Impact on mobile broadband usage

Figure 26: Netflix Broadband Partners

Figure 27: Netflix Competitor Set

...Members of the Telco 2.0 Executive Briefing Subscription Service and Dealing with Disruption Stream can download the full 33 page report in PDF format here. Non-Members, please subscribe here. For other enquiries, please email / call +44 (0) 207 247 5003.

Technologies and industry terms referenced include: Netflix, content, entertainment, disruption, OTT, video, VOD, HBO, Time Warner, BSkyB, cable, telco, telecoms, strategy, pay TV.