Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

| Summary: Our latest report on M2M 2.0 covers: M2M market growth, structure and dynamics; business models; the best role(s) for telcos; and leading thinking from Deutsche Telekom, Vodafone, Telenor, KPN and Swisscom. It describes how 'Service Enablers' are key to the telco opportunity in M2M in addition to connectivity. (July 2011, Executive Briefing Service) |

|

Below is an extract from this 39 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service here. Non-members can buy a Single User license for this report online here for £595 (+VAT) or subscribe here. For multiple user licenses or other enquiries please email or call +44 (0) 207 247 5003.

To share this article, please click:

Our previous M2M 2.0 research includes: M2M 2.0: New Approaches Needed; Aligning M2M with Telco 2.0 Strategies; and M2M / Embedded Market Overview, Healthcare Focus, and Strategic Options. M2M is also a theme of the upccoming New Digital Economics Exeutive Brainstorms in H2 2011, and there is a thought-provoking video (registration required) by Ericsson on the 'Social web of things' on our Best Practice Live! site.

The grand vision of 50 Billion connected devices looks a long way distant when contemplating the ‘cottage industry’ that is M2M today.

While there are lots of possibilities for connecting devices usefully, there are numerous challenges to doing it well and growing the market to its full potential:

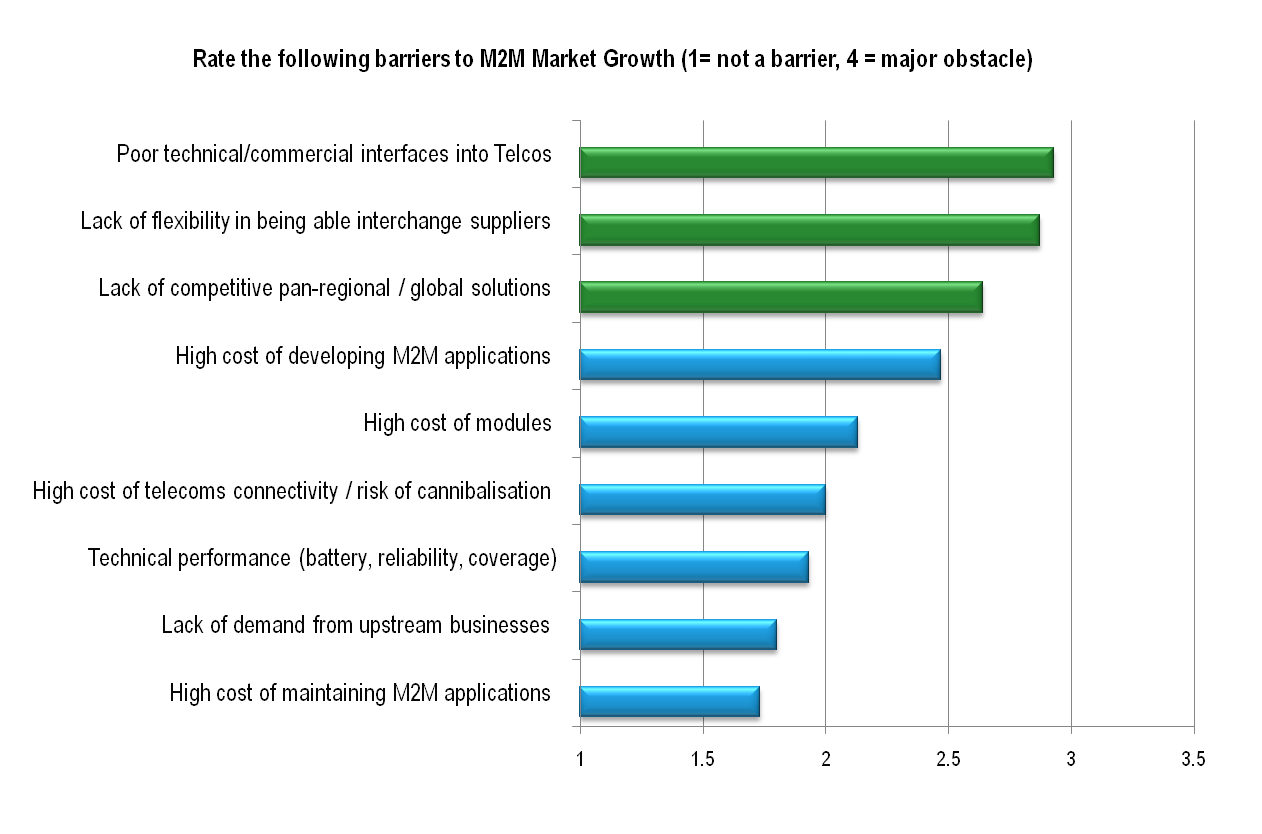

There are also industry barriers to the take-up of current offerings, such as

Figure 3 (Extract) - The Key Challenge for M2M Growth is to Create a Broad, Open Market

Source: Delegate Vote, 11th Telco 2.0 EMEA Brainstorm

It is our view (and that of the attendees at our last M2M brainstorm) that the pure connectivity revenues (to be paid for delivering the data from machine to machine) will become highly commoditised and low margin.

The “growth opportunity” will be in Software Enabling Services (SES), responsible for such activities as device provisioning, update/rollback of device software and firmware, data-warehousing, and some forms of data reduction pushed down into the network. These could be delivered traditionally or as Software-as-a-Service (SaaS).

The complex driving and structural factors lead to a high degree of uncertainty in the Industry’s view of the market opportunity. For example, on average, delegates thought that by 2015, service enabler revenues would comprise a value of 78% of connectivity revenues - although this average was formed by a large group that thought it would be in the range 20-40% and a small minority that thought it would be much higher (>200%)

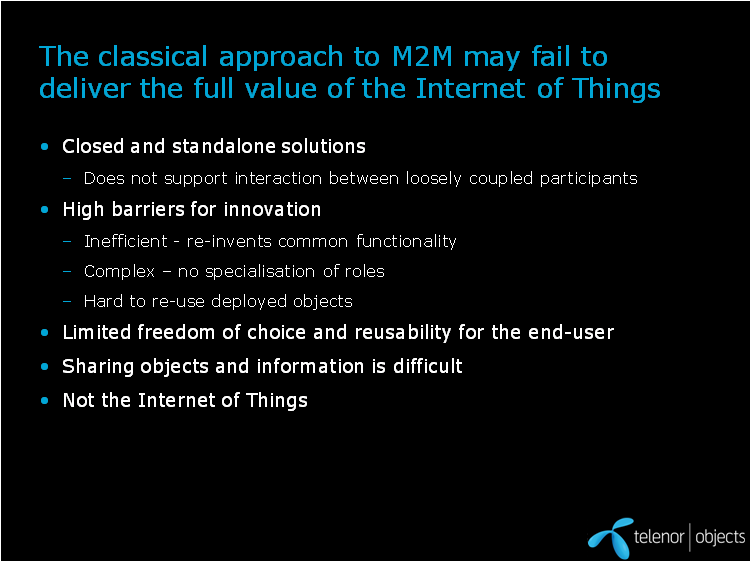

Operators can add value by making it easier to use their connectivity and providing more “M2M-friendly” interfaces – often described as managed connectivity. Beyond this, they can look to create and participate in the service enablers market for developers/application providers to easily identify, authenticate, provision, and maintain their device fleet; to update and rollback software on the devices and enable them to deploy processing logic into the “Internet of things” in order to render the system more robust, distributed, and autonomous.

Some operators already have the skills and resources to offer the application development, implementation and service hosting on top of this. Summarised in the report are examples of leading thinking and practice including Vodafone’s Global M2M Platform, Telenor Objects, Deutsche Telekom’s ‘Intelligent Network’, KPN’s and Swisscom’s platforms, plus we have previously reported on Verizon’s Open Development Initiative (ODI) in the US.

Figure 7 (Extract) - Why The Classical Approach to M2M May Fail

Source: Telenor Presentation

The industry as a whole has made rapid progress but could do much more to stimulate the embedded mobility market and drive growth through standards, interoperability and portability. The industry’s historical reluctance to do more to open itself up has left it vulnerable to being marginalized. The GSMA’s recent acceptance of over-the-air (OTA) SIM update, opens up the promise of more practical ways for an M2M customer to switch operator. It now rests on the industry (or failing that, the regulatory authorities) to deliver this promise.

M2M is growing up as an industry, and becoming more coherent and adopting increasingly similar concepts and vocabulary. However, as the wide variation in voting testifies, there is still considerable divergence in understanding and vision.

The M2M Opportunity is potentially significant but does not necessarily belonging to cellular networks, particularly if the industry does not work out how to create more common models that allow customers to use M2M in the way they actually need to use it – flexibly, seamlessly and cheaply.

While there is much energy in the debate on Machine-to-Machine in the operator community, there is widespread recognition that it is still something of a ‘cottage industry’ for operators at present, and a welcome sense of realism in that operators seem to understand that they don’t have all the answers. The core strategic challenge is to find a model that will scale beyond bespoke vertical industry applications.

While there is not yet a straightforward consensus on the relative value of service enablers compared to connectivity, our view remains that telcos need to develop the service enabler model as the connectivity market will be highly commoditised. We will continue to work to support this community, develop the service enabler model, and promote collective industry progress on M2M.

To read the full 39 page report, including analysis of the presentations, voting and delegate analysis from the M2M 2.0 Executive Brainstorms in April 2011, and London in November 2010, and the following charts...

......Members of the Telco 2.0 Executive Briefing Subscription Service can download the full 39 page report in PDF format here. Non-Members, please see here for how to subscribe, here to buy a single user license for £595, or for multi-user licenses and any other enquiries please email or call +44 (0) 207 247 5003.

Organisations, products and industry terms referenced: API, ARPU, Beecham Research, Bluetooth, Bosch, BT / Arqiva, Cincius, connected car, Deutsche Telekom, Embedded Mobile, energy, Enfora, Ericsson, Facebook, GSM, GSMA, healthcare, HLR, HTTP, IMSI, Indesit, intelligent networks, Internet of things, iPhones, Kindle, KPN, Logica, M2M, messaging, m-health, MNC, MVNE, MVNO, Novatel, Objects, Open Development Initiative, Orange, OTA, OTT, platforms, roaming, SaaS, Service Enabler, SIM, smart grid, SMS, Social Web of Things, Software-as-a-Service, spectrum policy, standardization, strategy, Swisscom, Telenor, Telenor Objects, T-Mobile, transport, USIM, Verizon, Vertical, Vertical M2M, Vodafone, WiMAX, Zigbee.