Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

|

Summary: ‘The Internet of Things’ (IoT) is one of the big ideas of the moment. But what are the areas in which value is being created now, and what is still technological hype? A summary of the findings of the Digital Things session at the 2013 Silicon Valley Brainstorm. (April 2013) |

|

Below are the high-level analysis and detailed contents from a 47 page Telco 2.0 Briefing Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service here. The Internet of Things will also be explored further at the EMEA Executive Brainstorm in London, 5-6 June, 2013, and we also run dedicated IoT Strategy Workshops. Non-members can find out more about subscriptions here or to find out more about any of these services, please email or call +44 (0) 207 247 5003.

To share this article easily, please click:

Part of the New Digital Economics Executive Brainstorm series, the 19th Telco 2.0 event took place at the InterContinental Hotel in San Francisco on the 19th and 20th of March, 2013. This report covers the Digital Things track on the second day, which was developed in partnership between STL Partners and Beecham Research.

Analysis: What’s Hot in the IoT?‘The Internet of Things’ (IoT) or ‘The Internet of Everything’ is one of the big ideas of the moment. But how much is technological hype and how much is value-creating reality?

Its close relative and precursor ‘Machine-To-Machine’ (M2M) had until relatively recently evolved as a telco-centric concept. Unlike the personality, publicity and hype driven world of smartphones and the Internet, M2M has been deeply embedded in industry processes, and generally siloed in industry verticals. ‘Industrial M2M’ is not going away: indeed it’s gathering pace and taking on new directions.

But recently the idea of ‘The Internet of Things’ has become something of a meme. It is certainly a hot topic amongst Silicon Valley technologists and investors, and this was reflected in the enthusiasm shown by the participants at our Executive Brainstorm in March 2013.

Definitions of the IoT vs. M2M are not yet standardised, although some of the common themes that are emerging are that the IoT is frequently cited as:

Some of the wider excitement has also been underpinned by futuristic predictions of 50bn connected devices, an idea which appeals to chip manufacturers, vendors, and telcos alike as they seek new avenues of growth. However, the questions of ‘but what will they be used for, why, and who will pay for it?’ have to date stood their ground, mostly unanswered.

Now, though, a combination of pressing economic necessities, improving economics of delivery, and increasing technical capabilities is forcing these questions up the agenda. In the North American market, the areas that are progressing fastest have clear economic rationales:

With new opportunities come new challenges, and one of the biggest new challenges, arising from healthcare applications in particular, is how to manage the complexities of collecting, transmitting, storing and analysing highly personal and personalised health data safely, securely, and legitimately. The safety-critical control systems of the “Industrial Internet” are no less sensitive.

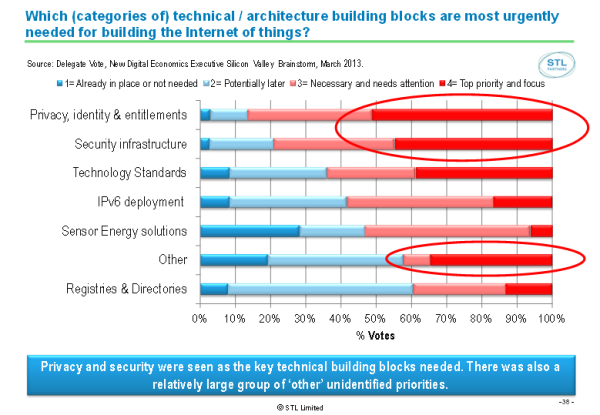

Evidently, effective security and trust networks are urgently required if the IoT’s potential is to be achieved, as the following chart shows.

In a world where people (and also jet engines) are having their health monitored automatically by numerous connected sensors, a lot of data is being amassed and needs to be monitored and analysed. Hence ‘Big Data’ is also a closely related topic to the IoT.

There are several other areas that are sometimes included under the banner of the ‘IoT’, for example:

There may indeed be opportunities in many of these areas, but the pressing economic, practical or social needs are not yet clear.

It is also not clear whether the definition of the ‘Internet of Things’ encompasses all of these ideas – although at present it would seem that anything that can be covered by this idea will be in someone’s world view.

What is clear is that the pace and diversity is increasing, and that new areas will continue to cross over from experiment to trial to mainstream development.

We will continue to research and explore the ‘Internet of Things’ at our Executive Brainstorms, with particular emphasis on the areas that are most likely to ‘flip over’ from speculation to application.

We will also look further into the needs and applications of ‘Big Data’ into the field, as well as continuing our involvement in the World Economic Forum’s (WEF) work on Trust Networks for personal data.

To read the note in full, including the following sections detailing additional analysis...

...and the following figures...

...Members of the Telco 2.0 Executive Briefing Subscription Service can download the full 47 page report in PDF format here. Non-Members, please subscribe here. The Internet of Things will also be explored in depth at the EMEA Executive Brainstorm in London, 5-6 June, 2013. For this or any other enquiries, please email / call +44 (0) 207 247 5003.

Background & Further Information

Produced and facilitated by business innovation firm STL Partners, the 2013 Silicon Valley event overall brought together 150 specially-invited senior executives from across the communications, media, retail, banking and technology sectors, including:

Around 50 of these executives participated in the ‘Internet of Things’ session.

The Brainstorm used STL’s unique ‘Mindshare’ interactive format, including cutting-edge new research, case studies, use cases and a showcase of innovators, structured small group discussion on round-tables, panel debates and instant voting using on-site collaborative technology.

We’d like to thank the sponsors of the Brainstorm: