Summary: The traditional business models for fixed and mobile operators are under pressure in all core products - voice, messaging, broadband access - particularly in mature markets.

A new business model is described here: one where operators make money from new types of customers rather than exclusively from end-users - and the business opportunity is potentially very large - c$125Bn. This additional, incremental revenue to the $250Bn described in the Future Broadband Business Models Report. This report is designed to help readers understand the nature and size of this new business model opportunity in its entirety.(March 2008)

To share this article easily, please click:

This report is now availalable to members of our Telco 2.0 Research Executive Briefing Service. Below is an introductory extract and list of contents from this strategy Report that can be downloaded in full in PDF format by members of the executive Briefing Service here.

For more on any of these services, please email / call +44 (0) 207 247 5003

The report is a must-have for strategists, marketers, technologists, and strategic business development professionals in operators and vendors who seek to position their company to take advantage of this new opportunity.

Strategists and CxOs in Media, “Upstream”, and Investment Companies may also find this report useful to understand the future landscape of the Telecoms and related industries, and to help to spot likely winning and losing investment and operational strategies in the market.

Thus far, operators have looked to replicate this business model in adjacent markets. Fixed operators have moved into mobile markets; mobile and fixed operators have sought to make money in fixed broadband. Operators are also charging users for new services, such as content delivery, with the launch of IPTV and mobile TV. The larger players in mature markets are aggressively expanding into emerging markets, such as China and India, where subscriber growth is still available.

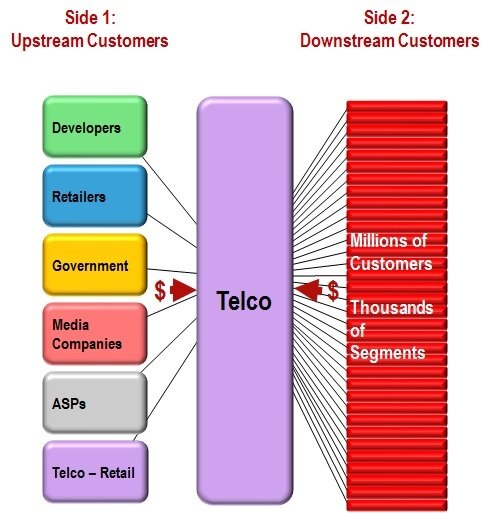

But, as we have shown in the preceding report to this on Future Broadband Business Models, this activity is not enough. All mature markets are becoming more competitive and emerging market growth will slow in the next few years. A new business model is required: one where operators make money from new customers rather than exclusively from end-users. For background on the 2-sided telecoms market opportunity, click here for a short presentation.

Some operators have begun to look at one 2-sided market: advertising. We cover this at length in our report Telcos' Role in the Advertising Value Chain. Many, however, have concluded that on its own it is not big enough to provide substantial revenue growth (or indeed to fill the gap left by declining subscription revenues).

This report is designed to help readers understand the nature and size of this new business model opportunity in its entirety. It looks beyond the advertising opportunity to other areas where operators could provide value and generate revenue. It lays out the key principles and strategies for success for fixed and mobile operators and recommends specific actions for moving forward.

Our belief is that the total two-sided market opportunity is of huge strategic importance for operators. Advertising is only one step for operators to add value to upstream customers (government, advertisers, merchants, application developers, content owners etc.) and end users (businesses and consumers):

The report describes the common set of underlying enablers required to enable upstream players to interact effectively with downstream end-users, and shows how operators have the necessary assets and competencies to build such a platform.

It also explores the key lessons from other successful platform players (Akamai, Google, Amazon, Ebay, Monster, iTunes, The London Stock Exchange, Betfair, Maersk) and identifies a way forward for operators:

In addition, the report seeks to help operators and vendors maximise future opportunities from operator services by answering the following questions:

Detailed Case Studies: Akamai, Amazon, AP Moller-Maersk, Betfair, Blyk, BT, Google, Monster, Vodafone.

Other Companies and Services Covered: Agriculturaljobs.net, Amazon, Amazon Kindle, Apple, Apple TV, Babelgum, Bank of America, BBC, BBC iPlayer, Bebo, Betavine, Betfair, Blyk, BT 21CN, BT Click & Buy, BT Counterpane, BT Fresca, BT Tradespace, BT Vision, Channel 4, China Mobile, Cyworld, Ebay, Equifax, Expedia, Experian, Fed Ex, Flickr, France Telecom, Genie, Google, GSMA, iTunes, ITV, Jajah, Joost, Kelkoo, Lastminute.com, London Stock Exchange, Mac OS, Maersk Logistics, Microsoft, MMA, Monster, MSN, Napster, Nextag, Nike, Nokia, O2, Opodo, Orange, Payforit, Paypal, Phorm, Pioneer Massive, Playstation, Price Runner, Prime Location, Real Networks, Rolls-Royce, Screen Tonic, Second Life, SK Telecom, Sky, Skype, Teddy Bear Search Engine, Telefonica, Tesco, The Cloud, The Ladders, Tivo, T-Mobile, Truphone, UPS, Verisign, Virgin USA, Visa, Vista, Vizzavi, Vodafone, Vodafone, Windows Software Developers Kit, Yahoo!, YouTube.

Technologies & Applications Covered: ATM, Bluetooth, BSS-OSS, Carrier Voice, DIAMETER, DRM, Enhanced Carrier Voice, IM, IPTV, Java MIDP, Linux, Mobile, Mobile Payments, NGN, Open ID, Parlay-X, PSTN, RADIUS, SIM, SIP, SMS, Softsim, SS-7, SXIP, USIM, Voice, VOIP, WAP Gateway, Windows Cardspace, XMPP.

1. Executive Summary

2. Introduction

3. The Telco Platform Service Capabilities – Scope to Grow & Grow

4. Sizing the Platform Opportunity – United we Stand; Divided we Fall

5. Case Studies – Telecoms is lagging other Industries

6. Moving Forward

7. Appendix

This report is now availalable to members of our Telco 2.0 Research Executive Briefing Service. Below is an introductory extract and list of contents from this strategy Report that can be downloaded in full in PDF format by members of the executive Briefing Service here. To order or find out more please email , call +44 (0) 207 247 5003.