Summary: managing the role of new device categories in new and existing fixed and mobile business models is a key strategic challenge for operators. This report includes analysis of the practicalities and challenges of creating customised devices, best / worst practice, inserting ‘control points’ in open products, the role of 'ODMs', and reviews leading alternative approaches.

As part of its recently-published report on Mobile and Fixed Broadband Business Models, Telco 2.0 highlighted four potential strategic scenarios, one of which was for operators to become “device specialists” as a deliberate element of strategy, either in wireline and wireless domains. This theme was also covered at the April 2010 Telco 2.0 Brainstorm event in London.

Clearly, recent years have displayed accelerating innovation in numerous “end-point” domains – from smartphones, through to machine-to-machine systems and a broad array of new consumer electronics products. Yet there has been only limited effort made in mapping this diversity onto the broader implications for operators and their business prospects.

An important aspect of device specialisation for telcos is one of attitude and philosophy. In the past, the power of the network has had primacy – large switching centres were at the heart of the business model, driving telephones – in some cases even supplying them with electrical power via the copper lines as well. Former government monopolies and powerful regulators have further enshrined the doctrines of central control in telecom executives’ minds.

Yet, as has been seen for many years in the computing industry, centralised systems give way to power at the edge of the network, increasingly assisted by a “cloud” of computing resource which is largely independent of the “wiring” need to connect it. The IT industry has long grasped the significance of client/server technology and, more recently, the power of the web and distributed computing, linked to capable and flexible PCs.

But in the telecom industry, some network-side traditionalists still refer to “terminals” as if Moore's Law has no relevance to their businesses' success. But the more progressive (or scared) are realising that the concentration of power “at the telecom edge”, coupled with new device-centred ecosystems (think iPhone + iTunes + AppStore), is changing the dynamics of the industry to one ruled by a perspective starting from the user's hand back inwards to the core.

With the arrival of many more classes of “connected device” - from e-readers, to smart meters or in-vehicle systems – the role of the device becomes ever more pivotal in determining both the structure of supporting business models and the role of telcos in the value chain. It also has many implications for vendors.

The simplest approach is for operators to source and give away attractive devices in order to differentiate and gain new, or retain existing customers – especially in commoditised access segments like ADSL. At the other end of the spectrum, telcos could pursue a much deeper level of integration with new services to drive new fixed or mobile revenue streams – or create completely unique end-to-end propositions to rival those of 3rd-party device players like Apple, Sony or TiVo.

This Executive Brief examines the device landscape from an operator's or network vendor's standpoint. It looks at whether service providers should immerse themselves in creating on-device software and unique user experiences - or even commission the manufacture of custom hardware products or silicon. Alternatively, it considers the potential to “outsource” device smarts to friendlier suppliers like RIM or Thomson/Technicolor, which generally have operators' success at the centre of their strategies. The alternative may be to surrender yet more value to the likes of Apple, Sony or Sling Media, allowing independent Internet or local services to be monetised without an “angle” for telco services.

The answer is for telcos to attempt to take control of more of this enormous “edge intelligence”, and exploit it for their own benefit and in-house services or two-sided strategies.

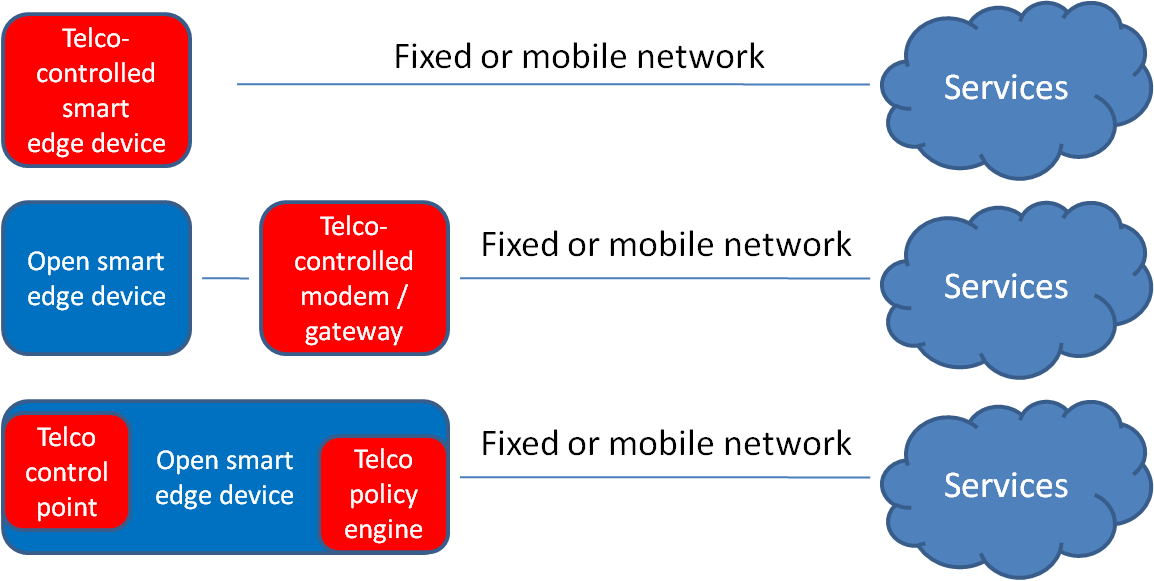

There are three main strategies for operators wanting to exert influence on edge devices:

Going back 30 years, before telecoms deregulation, many telcos were originally device specialists. In many cases, the incumbent government monopolies were also the only source of supply of telephones and various other communications products (“CPE” - customer premises equipment) – often renting them to users rather than selling them. Since then of course, much has changed. Not only have customers been able to buy standards-compliant, certified terminals on the open market, but the rise of personal computing and mobile communications has vastly expanded the range and capability of end-points available.

But while few telcos could benefit today from owning physical manufacturing plants, there is an increasing argument for operators once again to take a stronger role in defining, sourcing and customising end-user hardware in both mobile and fixed domains. As discussed throughout this document, there is a variety of methods that can be adopted – and also a wide level of depth of focus and investment. Clearly, owning factories is unlikely to be an attractive option – but at the other end of the scale, it is unclear whether merely issuing vague “specifications” or sticking logos on white-labelled goods from China really achieves anything meaningful from a business model standpoint.

It is instructive to examine a few case studies of operator involvement in the device marketplace, to better understand where it can add value as a core plank of strategy, rather than simply as a tactical add-on.

Perhaps the best example of a device-centric operator is NTT DoCoMo in Japan. It would perhaps be more accurate to describe the firm as a technology-centric firm, as it pretty much defines its complete end-to-end system in-house, usually as a front-runner for more general 3GPP systems like WCDMA and LTE, but with subtle local modifications.About 10 years ago, it recognised that handset development was going to be a pivotal factor in delaying its then-new 3G FOMA services, and committed very significant funds to driving the whole device ecosystem to accelerate this.

In fact, DoCoMo has a very significant R&D budget in general, which means that it has been able to develop complete end-to-end platforms like i-Mode, spanning both handset software and back-end infrastructure and services. Although it is known for initiatives like these, as well as its participation in Symbian, Android and LiMo ecosystems, its device expertise goes far beyond handset software. For example, its own in-house research journal covers innovative areas of involvement, such as:

Improved video display on handsets

Development of its own in-vehicle 3G module for telematics applications

Measurement of handset antenna efficiency

In some ways, DoCoMo is in a unique position. It did not have to pay for original 3G spectrum and channelled funds into device and infrastructure development instead. It also operates in an affluent and gadget-centric market that has at times been willing to spend $500-600 on massmarket handsets. It has close ties with a number of Japanese vendors, with whom it spends large amounts on infrastructure and joint R&D. And its early pragmatism with web and software developers (in terms of revenue-share) has largely kept the ecosystem “on-side”, compared with other markets in which a mass of disgruntled application providers have eagerly jumped on off-portal and “open” OS platforms, to the detriment of operators.

In its financial year to March 2009, DoCoMo had a total R&D spend of 100 billion Yen (approximately $1bn). While this is split across both basic research and various initiatives around networks and services, it also has a dedicated “device development” centre. It compares to R&D spending by Vodafone Group in the same period of £280m, or about $450m, while mid-size global mobile group Telenor spent just NOK1.1bn ($180m) in calendar year 2008. For comparison, Apple’s current annualised R&D spend is around $1.6bn per year, and Google’s is $3.2bn - while Nokia’s was over $8bn in 2009 – albeit spread across a much larger number of products, as well as its share in NSN. Even smaller device players such as SonyEricsson spend >$1bn per year.

Although DoCoMo is best known for its handset software involvement – i-Mode, Symbian, LiMo, MOAP and so forth – it also conducts a significant amount of work on more hardcore technology platform development. Between 2005 and 2007, for example, it invested 12.5 billion Yen ($125m) in chipset design for its 3G phones.

It has huge leverage with Japanese handset manufacturers like NEC and Matsushita, as they have limited international reach. This means that DoCoMo is able to enforce adoption of its preferred technology components – such as single integrated chips that it helps design, rather than multiple more expensive processors.

While various operators are now present in handset-OS organisations such as the LiMO Foundation and Open Handset Alliance (Android), DoCoMo's profile in device software has been considerably greater in the past. It is a founder member of Symbian, driving development of one of the original 3 Symbian user interfaces (the other two being Nokia's S60 and the now-defunct UIQ). DoCoMo now makes royalty revenues, in some instances, from use of its handset software by manufacturers. It also owns a sizeable stake in browser vendor Access, and has also invested in other handset software suppliers like Aplix.

From the discussion about DoCoMo above, it is clear that for an operator to start creating its own device platform from the bottom up, it will need extremely deep pockets and very close relationships with willing OEMs to use its designs. For individual handsets or a small series of similar devices, it can clearly choose the ODM route, although this risks limiting differentiation to a thin layer of software and a few “off the peg” hardware choices.

Another option is to try to create a fully-fledged hardware ecosystem, putting in place the tools and business frameworks to help innovative manufacturers create a broad set of niche “long tail” devices that conform to a given operator's specifications. If successful, this enables a given telco to benefit from a set of unique devices that may well come with new business models attached. Clearly, the operator needs to be of sufficient scale to make the volumes worthwhile – and there also needs to be a guarantee of network robustness, channels to market and back-office support.

Verizon's “Open Device Initiative” is perhaps the highest-profile example of this type of approach, aiming to foster the creation of a wide range of embedded and M2M products. It assists in the certification of modules, and also links in with its partnership with Qualcomm and nPhase in creating an M2M-enabling platform. A critical aspect of its purpose is a huge reduction in certification and testing time for new devices against its network – something which had historically been a time-to-market disaster lasting up to 12 months, clearly unworkable for categories like connected consumer-oriented devices. It has been targeting a 4-week turnaround instead, working with a streamlined process involving multiple labs and testing facilities.

US rival operator AT&T is attempting a similar approach with its M2M partner Jasper Wireless, although Verizon ODI has been more conspicuous to date.

Another interesting approach to device creation is that espoused by the Hutchison 3 group. Its parent company, Hutchison Whampoa, set up a separately-branded device subsidiary called INQ Mobile in October 2008. INQ specialises in producing Internet-centric featurephones with tight integration of web services like Skype, Facebook and Twitter on low-cost platforms. Before the launch of INQ, 3 had already produced an earlier product, the SkypePhone, but had not sold that to the outside marketplace.

At around $100 price points, it is strongly aimed at prepaid-centric or low-subsidy markets where users want access to a subset of Internet properties, but without incurring the costs of a full-blown smartphone. It has worked closely with Qualcomm, especially using its BREW featurephone software stack to enable tight integration with web services and the UI. That said, the company is now switching at least part of its attention to Android-based devices in order to create touchscreen-enabled midmarket devices.

3/INQ highlights one of the paradoxes of operator involvement in device creation – while it is clearly desirable to have a differentiated, exclusive device, it is also important to have a target market of sufficient scale to justify the upfront investment in its creation. Setting up a vehicle to sell the resulting phones or other products in geographies outside the parent's main market footprint is a way to grow the overall volumes, without losing the benefits of exclusivity.

In this sense, although the 3 Group clearly benefits from its association with INQ, it is not specifically part of the operator's strategy but that of its ultimate holding company. The separate branding also makes good sense. It is also worth noting that 3 is not wholly beholden to INQ for supply of own-brand devices; its current S2x version of its Skypephone is manufactured by ZTE.

It is also worthwhile discussing one of the less-successful device initiatives attempted by operators in recent years. Between 2003-2009, BT developed and sold a fixed-mobile converged service called Fusion, which flipped handsets between an ordinary outdoor cellular connection and a local wireless VoIP service when indoors and connected to a BT broadband line.

Intended to reduce the costs associated with use of then-expensive mobile calls, when in range of “free” landline or VoIP connections, it relied on switching to Bluetooth or WiFi voice when within range of a suitable hotspot. The consumer and small-business version relied on a technology called UMA (Universal Mobile Access), while a corporate version used SIP. The mobile portion of the service used Vodafone's network on an MVNO basis.

Recognising that it needed widespread international adoption to gain traction and scale, BT did many things that were “right”. In particular, it supported the creation of the FMCA (Fixed-Mobile Convergence Alliance) and engaged directly with many handset vendors and network suppliers, notably Motorola for devices and Alcatel-Lucent for systems integration. It also ran extensive trials and testing, and participated in various standards-setting fora.

The service never gained significant uptake, blamed largely on falling prices for mobile calls which reduced the core value proposition. It also reflected a very limited handset portfolio, especially as the technology only supported 2G mobile devices at launch – at just the point when many higher-value customers wanted to transition to 3G.

Conversely, lower-end users generally tend to use prepaid mobile in the UK, which did not fit well with BT's contract-based pricing oriented around Fusion's position as an add-on to normal home broadband. In addition, there were significant issues around the user interface, and the interaction of the UMA technology with certain other uses of the WiFi radio that the user did not wish to involve the operator.

The main failure for BT here was in its poor focus on what its customers wanted from devices themselves, as well as certain other aspects of the service wrapper, such as numbering. It was so focused on some of the network and service-centric aspects of Fusion (especially “seamless handover” of voice services) that it ignored many of the reasons that customers buy mobile phones – a range of device brands and models, increasing appeal of 3G, battery life, the latest features like high-resolution cameras and so forth. Towards the end of Fusion's life, it also looked even weaker once the (unsupported) Apple iPhone raised the bar for massmarket adoption of smartphones. It was withdrawn from sale in early 2009.

BT also overlooked (or over-estimated) the addressable market size for UMA-enabled phones, which should have made it realise that support of the technology was always going to be an afterthought for the OEMs. It also over-relied upon Motorola for lower-end devices, and supported Windows Mobile for its smartphone variants more for reasons of pragmatism than customer demand.

Lastly, BT appears to have underestimated the length of time it would take to get devices from concept, through development and testing to market. In particular, it takes many years (and a clear economic rationale) for an optional feature to become built-into mobile device platforms as standard – and until that occurs, the subset of devices featuring that capability tends to be smaller, more expensive, and often late-to-market as OEMs focus their best engineers and project resources on more scalable investments.

Perhaps the main takeaway here is that telcos' involvement in complex, technology-led device creation is very risky where the main customer benefit is simply cheaper services, in markets where the incumbent providers have scope to reduce margins to compete. A corollary lesson is that encouraging device vendors to support new functions that only benefit the operators (and only a small proportion of customers) is tricky unless the telcos are prepared to guarantee better purchase prices or large volumes. This may well be a reason that leads to the failure of other phone-based enhancements, such as NFC to date.

To read or download a PDF of the 45 page report in full, covering...

...Members of the Telco 2.0TM Executive Briefing Subscription Service please see here. Non-Members, please see here for how to subscribe. Please email or call

+44 (0) 207 247 5003 for further details.