| Summary: our in-depth look at the UK’s highly competitive digital TV market which reflects many global trends, such as competition between different types of content distributor (LoveFilm, YouTube, Virgin Media, BBC, BSkyB, BT, etc.), channel proliferation, new devices used for viewing, and the increasing prevalence of connected TVs. What are the key trends and who will be the winners and losers? (August 2011, Executive Briefing Service) |

|

Below is an extract from this 23 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service here. Non-members can buy a Single User license for this report online here for £595 (+VAT) or subscribe here. For multiple user licenses, or to book a place at our Digital Entertainment 2.0 workshop on New Business Models for the Home Video Entertainment market in Europe - Lessons from America at our London Executive Brainstorm on 8th November, please email or call +44 (0) 207 247 5003.

To share this article easily, please click:While it is difficult to generalise with TV markets across the globe as the markets are fundamentally different in structure, especially with key variables such as PayTV penetration, state broadcaster involvement and fast broadband penetration varying widely, the comprehensive range of players and highly competitive nature of the UK market makes it a useful benchmark for many key global trends.

According to OFCOM’s latest research, there are 26.6m TV households in the UK with 60m TV sets or an average of 2.25 TV sets per household.

Figure 1 - Average UK TV Viewing Per Day

Source: BARB.

TV viewing over the last few years has been remarkably resilient despite the internet and other platforms competing hard for attention. Where the TV market differs is that average consumption is very strongly proportional to age. In typical technology adoption cycles, adoption is indirectly proportional to age. This presents a real challenge to the connected TV market: the main TV consumers are more than likely to be adverse to technological change.

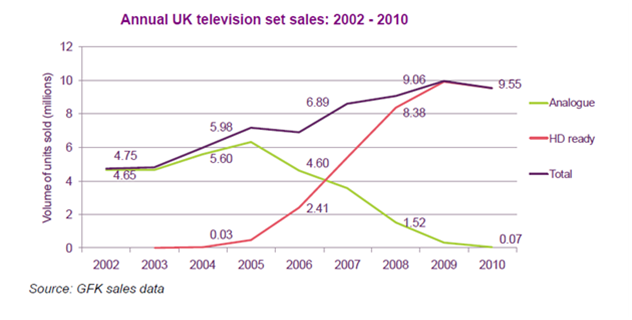

Figure 2 - Annual UK TV Set Sales by Type 2002-2010

The long term volume trend for TV manufacturers has been healthy. This has mainly been due to the innovation in device form and screen quality, with flat screen and HD features becoming the norm. TV manufacturers are now hoping that internet connected TV’s will generate another spurt in growth. Samsung and Sony are the UK market leaders.

But the challenge is the replacement cycles. With a 60m installed base of TV’s in the UK, and assuming that all the 9.5m TV’s sold in 2010 are replacements and not simply increasing the number of sets per household, the implication is that the replacement cycle is currently roughly every six years at a minimum. This is relatively slow when compared to two years for mobile phones and three years for laptops, and this in turn suggests that the adoption rate for standalone connected TVs will be much slower than the technology cycles for these devices.

While we expect internet connectivity to become a pretty standard feature with TV over the next couple of years we are sceptical about their active use for viewing video. The content offering is currently too limited. We would be surprised if within a couple of years, there are more than 1m homes regularly using TVs to watch video over the internet.

The Set Top Box market in the UK falls into two categories: a subsidised segment which the consumer generally gets either for free or heavily discounted by their PayTV provider; and a retail segment where the consumer generally pays a full price and gives the consumer access to a limited set of free to air (FTA) channels and quite often DVR features.

In the subsidised segment, the market leader is Sky which currently manufacturers its own boxes. All the current models contain internet connectivity but require a subscription to Sky Broadband service to access Sky's closed pull VOD service, Sky Anytime+. Sky has seeded the market for quite a few years with its Sky+ HD boxes which are currently in a minimum of 3,822k UK homes. We say a minimum because the figure is for homes with a HD subscription and Sky also installs a HD box for homes who do not subscribe to HD. This market seeding strategy accounts for the high initial take-up of the Sky Anytime+ service of 800k in the first quarter of launch. Since the service is effectively free, or rather bundled into the Sky TV and Broadband prices, we expect a rapid take up and within a couple of years Sky will have over 4m homes with their main TV connected to the internet.

Virgin Media has chosen TiVo as its exclusive connected set top box provider. The TiVo box is more open than the Sky box with the future promise of allowing independent Flash developers to deploy applications. TiVo is off to a steady start with around 50k homes in the first quarter of 2011. We expect TiVo adoption to be slower than Sky because the need for a new box which is priced at £50 with an ongoing service fee of £3/month. We expect these prices to reduce over time, but still can envisage an uptake of over 2m homes within two to three years assuming effective promotion by Virgin Media.

Another interesting opportunity is the launch of YouView. YouView is expected to come in two flavours, subsidised by CSPs and retail. BT and TalkTalk are shareholders, and are committed to launching YouView boxes by Pace and Huawei respectively in time for the London Olympics in 2012. Humax is committed to launching retail boxes. It is too early to properly forecast demand for YouView as neither the pricing or applications have yet been revealed. However, we struggle to see an installed base of over 1m homes even with the large base of broadband connections that BT and TalkTalk can market the product to.

All the original BT Vision set top boxes were manufactured by Pace (through their purchase of Philips) and need to be connected to BT broadband and therefore the whole of 575k subscribers count as connected TVs. We expect over time for BT to replace these BT Vision boxes with YouView boxes.

The major problem for YouView is that it is a proprietary UK standard whereas other European countries are committing to the hbbTV standard. This places other set top box makers in something of a quandary - will the UK market be large enough to support product development costs? Sony, Technicolour and Cisco have already publically stated that they have no current plans to develop a YouView box.

Other commentators express confidence in the Bluray players to provide the TV connectivity. We are bears of Bluray players and think the market will be niche at best.

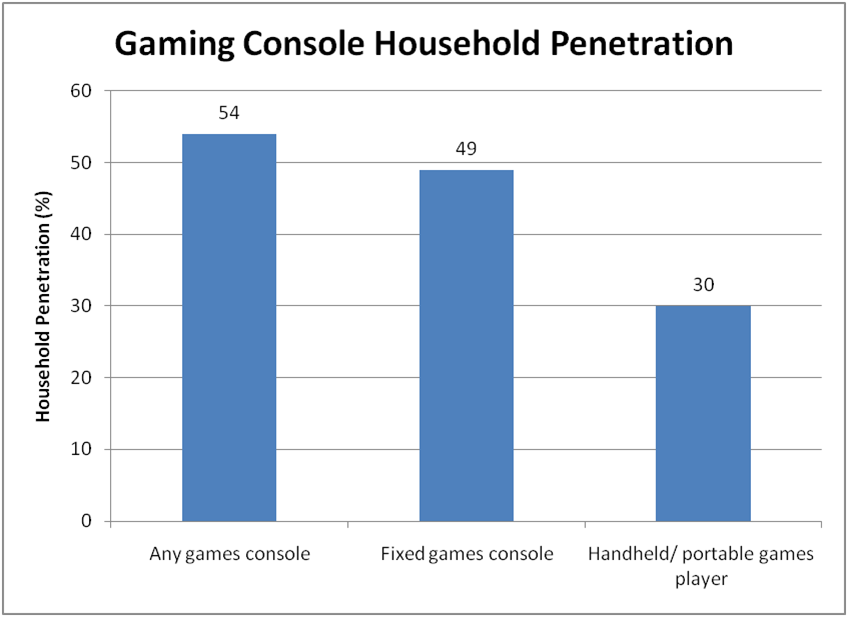

Figure 3 – Gaming Console Household Penetration

Source: Ofcom residential tracker, w1 2011. Base: All adults 16+ (3,474)

Around half of UK homes contain a games console. The market is dominated by Microsoft, Sony and Nintendo and a growing number of consoles are connected to the internet. Primarily, for online gaming, but also for watching video content either via the internet or through playback of physical media such as DVD or Bluray.

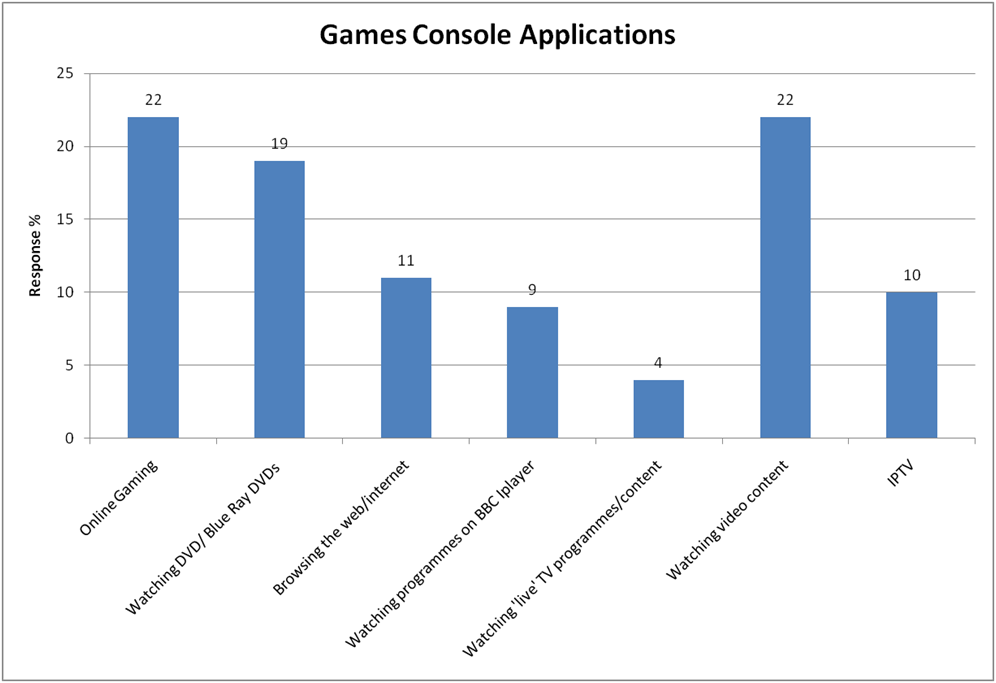

Figure 4 – What UK Consumers use games consoles for

We expect Gaming Consoles to become the most important method for secondary TV sets to connect to the internet, especially in children’s bedrooms. As more and more gaming moves online, we can easily see 75% of gaming consoles regularly connecting to the internet (c. 10m). However, the proportion using the console for regularly viewing video will remain small, perhaps as low as 20%. This will mean that although important Gaming Consoles will be secondary to STB’s for watching video over the internet.

To read the note in full, including additional analysis on...

...and the following charts...

...Members of the Telco 2.0 Executive Briefing Subscription Service can download the full 23 page report in PDF format here. Non-Members, please see here for how to subscribe, here to buy a single user license for £595 (+VAT), or for multi-user licenses and any other enquiries please email or call +44 (0) 207 247 5003.

Organisations and products referenced: Amazon, Apple, AppleTV, BBC, BSkyB, BT, BT Vision, Cisco, Flash, Google, Huawei, Humax, ITV, LoveFilm, Microsoft, Motorola, Nintendo, O2, OFCOM, Orange, Pace, Philips, Samsung, Sky, Sky Anytime+, Sky Go, Sony, TalkTalk, Technicolour, TiVo, TV manufacturers, Virgin Media, YouTube, YouView .

Technologies and industry terms referenced: Bluray, catch-up TV, Connected TV, Digital Terrestrial, DVD, DVR, flat screen, free to air, Games Consoles, hbbTV, HD, IPTV, online, PayTV, regulatory relief, replacement cycles, Set Top Box, Tablets, Video, Video on demand (VOD).