|

Summary: Changing consumer behaviours and the transition to 4G are likely to bring about a fresh surge of video traffic on many networks. Fortunately, mobile content delivery networks (CDNs), which should deliver both better customer experience and lower costs, are now potentially an option for carriers using a combination of technical advances and new strategic approaches to network design. This briefing examines why, how, and what operators should do, and includes lessons from Akamai, Level 3, Amazon, and Google. (May 2013, Executive Briefing Service). |

|

Below are an introductory extract and detailed contents from a 18 page Telco 2.0 Briefing Report that can be downloaded in full in PDF format by members of the Premium Telco 2.0 Executive Briefing service here. Digital Infrastructure will also be explored further at the EMEA Executive Brainstorm in London, 5-6 June, 2013. Non-members can find out more about subscribing here, or find out more about this and/or the Brainstorm by emailing or calling +44 (0) 207 247 5003.

To share this article easily, please click:

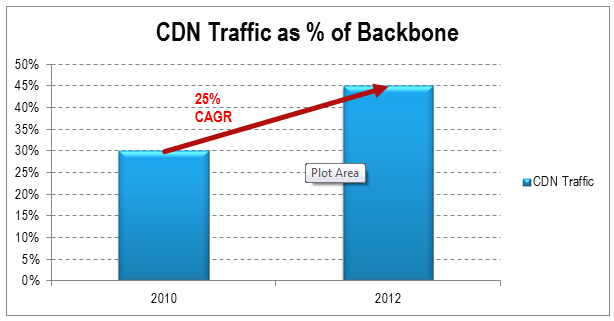

Content delivery networks (CDNs) are by now a proven pattern for the efficient delivery of heavy content, such as video, and for better user experience in Web applications. Extensively deployed worldwide, they can be optimised to save bandwidth, to provide greater resilience, or to help scale up front-end applications. In the autumn of 2012, it was estimated that CDN providers accounted for 40% of the traffic entering residential ISP networks from the Internet core. This is likely to be an underestimate if anything, as a major use case for CDN is to reduce the volume of traffic that has to transit the Internet and to localise traffic within ISP networks. Craig Labovitz of DeepField Networks, formerly the head of Arbor’s ATLAS instrumentation project, estimates that from 35-45% of interdomain Internet traffic is accounted for by CDNs, rising to 60% for some smaller networks, and 85% of this is video.

Source: DeepField, STL

In the past, we have argued that mobile networks could benefit from deploying CDN, both in order to provide CDN services to content providers and in order to reduce their Internet transit and internal backhaul costs. We have also looked at the question of whether telcos should try to compete with major Internet CDN providers directly. In this note, we will review the CDN business model and consider whether the time has come for mobile CDN, in the light of developments at the market leader, Akamai.

Although CDNs account for a very large proportion of Internet traffic and are indispensable to many content and applications providers, they are relatively small businesses. Dan Rayburn of Frost & Sullivan estimates that the video CDN market, not counting services provided by telcos internally, is around $1bn annually. In 2011, Cisco put it at $2bn with a 20% CAGR.

This is largely because much of the economic value created by CDNs accrues to the operators in whose networks they deploy their servers, in the form of efficiency savings, and to the content providers, in the form of improved sales conversions, less downtime, savings on hosting and transit, and generally, as an improvement in the quality of their product. It’s possible to see this as a two-sided business model – although the effective customer is the content provider, whose decisions determine the results of competition, much of the economic value created accrues to the operator and the content provider’s customer.

On top of this, it’s often suggested that margins in the core CDN product, video delivery, are poor and it would be worth moving to supposedly more lucrative “media services”, products like transcoding (converting original video files into the various formats served out of the CDN for networks with more or less bandwidth, mobile versus fixed devices, Apple HLS versus Adobe Flash, etc) and analytics aimed at content creators and rightsholders, or to lower-scale but higher-margin enterprise products. We are not necessarily convinced of this, and we will discuss the point further on page 9. For the time being, note that it is relatively easy to enter the CDN market, and it is influenced by Moore’s law. Therefore, as with most electronic, computing, and telecoms products, there is structural pressure on prices.

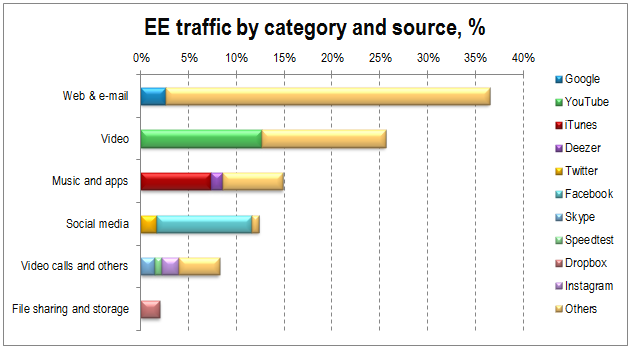

A major 4G operator recently released data on the composition of traffic over their new network. As much as 40% of the total, it turned out, was music or video streaming. The great majority of this will attract precisely no revenue for the operator, unless by chance it turns out to represent the marginal byte that induces a user to spend money on out-of-bundle data. However, it all consumes spectrum and needs backhauling and therefore costs money.

The good news is that most, or even all, of this could potentially be distributed via a CDN, and in many cases probably will be distributed by a CDN as far as the mobile operator’s Internet point of presence. Some of this traffic will be uplink, a segment likely to grow fast with better radios and better device cameras, but there are technical options related to CDN that can benefit uplink applications as well.

Source: EE, STL

Another 36.5% of the traffic is accounted for by Web browsing and e-mail. A large proportion of the Web activity could theoretically come from a CDN, too – even if the content itself has to be generated dynamically by application logic, things like images, fonts, and JavaScript libraries are a quick win in terms of performance. Estimates of how much Internet traffic in general could be served from a CDN range from 35% (AT&T) to 98% (Analysys Mason).

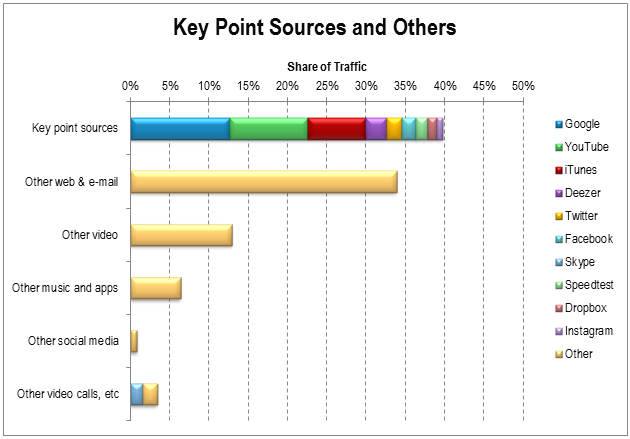

As 29% of their traffic originates from the top 3 point sources – YouTube, Facebook, and iTunes – it’s also observable that signing-up a relatively small subset of content providers as customers will provide considerable benefit. Out of those three, all of them use a CDN, and two of those – Facebook and iTunes – are customers of Akamai, while YouTube relies on Google’s own solution.

We can re-arrange the last chart to illustrate this more fully. (Note that Skype, as a peer-to-peer application that is also live, is unsuitable for CDN as usually understood.)

Source: EE, STL

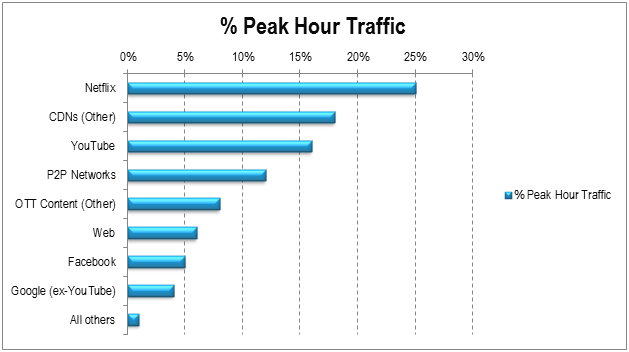

Looking further afield, the next chart shows the traffic breakdown by application from DeepField’s observations in North American ISP networks.

Source: DeepField

Clearly, the traffic sources and traffic types that are served from CDNs are both the heaviest to transport and also the ones that contribute most to the busy hour; note that these are peak measurements, and the total of the CDN traffic here (Netflix, YouTube, CDN other, Facebook) is substantially more than it is on average.

To read the Software Defined Networking in full, including the following sections detailing additional analysis...

...and the following figures...

...Members of the Telco 2.0 Executive Briefing Subscription Service can download the full 18 page report in PDF format here. Non-Members, please subscribe here. Digital Infrastructure will also be explored in depth at the EMEA Executive Brainstorm in London, 5-6 June, 2013. For this or any other enquiries, please email / call +44 (0) 207 247 5003.