|

Summary: Value is squeezed out of industries as they become increasingly digital - i.e. accessed by mobile and online, driven by data and defined by software. We call the collective economic impact of this pressure ‘The Great Compression’. But which companies will survive and prosper - and how? 90% of the Execs at our Silicon Valley brainstorm identified ‘management mindset’ as a key factor in Telecoms, Media, Finance and Retail. (May 2013, Executive Briefing Service, Transformation Stream). |

|

Below are the high-level analysis and detailed contents from a 62 page Telco 2.0 Briefing Report that can be downloaded in full in PDF format by members of the Premium Telco 2.0 Executive Briefing service and the Telco 2.0 Transformation Stream here. The Digital Economy, and the changes needed to 'management mindset', organisation, technology, and products, will also be explored further at the EMEA Executive Brainstorm in London, 5-6 June, 2013. Non-members can find out more about subscribing here, or find out more about this and/or the Brainstorm by emailing or calling +44 (0) 207 247 5003.

To share this article easily, please click:

Part of the New Digital Economics Executive Brainstorm series, the Silicon Valley 2013 event took place at the InterContinental Hotel in San Francisco on the 19th and 20th of March, 2013. This report covers the Digital Economy track on the first day.

Telecoms, telco vendors, entertainment, device makers, financial services, retailers, entertainment services, and brands in developed economies are experiencing the ‘Digital Hunger Gap’ - a shortfall of revenues versus past levels as industries become increasingly digital i.e. accessed by mobile and online, driven by data and defined by software.

Other industries are also feeling pain from the process of becoming digitised which both changes the model and the dynamics of competition. Others, like consumer goods and car manufacturing, see opportunities to enhance services with digital connectivity to build loyalty and new value. Government services and healthcare face huge cost challenges. Digital services can be of huge value here, but the challenge for third parties is how to make money when money needs to be saved.

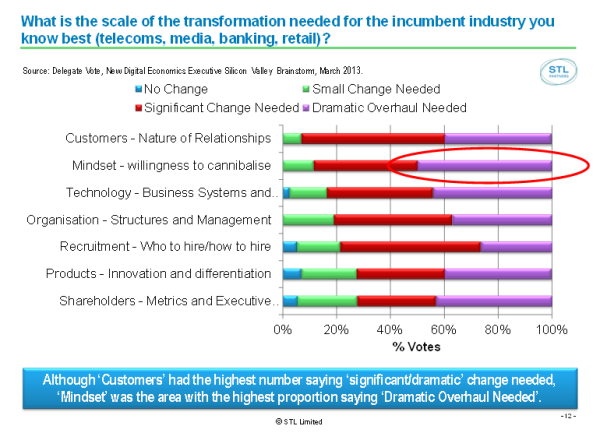

According to the participants in the Silicon Valley brainstorm, almost every industry faces massive changes in every area of its business model, with management mindsets most in need of a dramatic overhaul, and customer relationships marginally ahead in the total of partipants thinking a dramatic or significant change is needed.

New markets are emerging rapidly, particularly in Asia. However, many companies from North America and EMEA lack depth in local knowledge and face skills, cultural and political barriers to entry, and the mindset challenge of operating in a radically different economic environment.

As a result of the combined difficulties of growth in home markets and expansion abroad, there will be massive consolidation among traditional industry leaders in developed economies over the coming years. Those that are successful will continue to innovate as they consolidate, but it will be a huge struggle to survive for many.

We’re calling the collective economic impact of these pressures ‘The Great Compression’ as value is squeezed from existing industries. Those best positioned to profit through it have built defensible global or major regional strengths in horizontal areas with large-scale application and high barriers to entry, and/or that serve as ‘arms dealers’ to the rest of the digital economy. For example, chip makers and IP companies (e.g. ARM, Intel, Qualcomm), very large-scale / sophisticated IT manufacturers (e.g. Microsoft, Oracle, SAP), and ‘platforms’ (e.g. Apple, Google, Visa).

However, being well positioned is no guarantee of success, and all companies will face significant challenges requiring innovation and transformation. This in turn will require immediate and ongoing action by leadership teams in every company.

Digital innovation is increasingly itself becoming a little like the entertainment industry in that it is constantly seeking hits and highly vulnerable to hype. There are centres of innovation such as Silicon Valley and elsewhere, and there can only be a small number of highly successful ‘hits’ among the many thousands if not hundreds of thousands of attempts to make a hit. Finding, gaining a share in, nurturing, and ultimately profiting from these hits is a massive industry in itself. The recognised difficulty of doing this is a further barrier to success for many of the established players. Yet those that are to survive will need to overcome it.

To read the Digital Economy note in full, including the following sections detailing additional analysis...

...and the following figures...

...Members of the Telco 2.0 Executive Briefing Subscription Service and the Telco 2.0 Transformation Stream can download the full 62 page report in PDF format here. Non-Members, please subscribe here. The Digital Economy will also be explored in depth at the EMEA Executive Brainstorm in London, 5-6 June, 2013. For this or any other enquiries, please email / call +44 (0) 207 247 5003.

Produced and facilitated by business innovation firm STL Partners, the Silicon Valley 2013 event overall brought together 150 specially-invited senior executives from across the communications, media, retail, banking and technology sectors, including:

The Brainstorm used STL’s unique ‘Mindshare’ interactive format, including cutting-edge new research, case studies, use cases and a showcase of innovators, structured small group discussion on round-tables, panel debates and instant voting using on-site collaborative technology.

We’d like to thank the sponsors of the Brainstorm: