|

| Summary: Most executives across the European telecoms industry accept that the current telco business model is in decline (the ‘burning platform’), but wholehearted action to create sustainable new models is not in place. We identify the key barriers and next steps to overcome them in this top-level analysis of findings from our recent EMEA Executive Brainstorm. (July 2012, Executive Briefing Service, Transformation Stream.) |

|

Below is an extract from this 16 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service and the Telco 2.0 Transformation stream here. Non-members can subscribe here and for this and other enquiries, please email / call +44 (0) 207 247 5003.

To share this article easily, please click:

Executive Summary

The Burning Platform

It was clear at the Telco 2.0/New Digital Economics Brainstorm in London a few weeks ago that most executives across the European telecoms industry accept that the current telco business model is in decline (the ‘burning platform’), but wholehearted action to create sustainable new models is not in place.

Figure 1 – The burning platform illustrated: e.g. forecast decline in UK revenues

Source: Presentation by Chris Barraclough, Chief Strategist and MD Telco 2.0

Two thirds of delegates thought this leading indicator forecast ‘about right’ or ‘too optimistic’.

Telcos need to act more decisively

The core message to the leaders of the European telecoms industry is that they must make a more concerted effort to change direction now or will have much less control over their future destinies.

Some telcos are taking steps, but even the most advanced are still in experimental mode, and the rest somewhere between strategic slide-ware and tacit acceptance of a future as a 'pipe'.

As well as prudent re-pricing of data and diligence in cost and efficiency management, the primary opportunities for telcos are to re-conceive the core communications proposition, re-define the overall experience of being a telco customer and ultimately to create interoperable multi-sided business models that help 3rd parties and end-users (people, organisations and devices) connect in more efficient and effective ways. These actions will create a more valuable and defensible role for telcos in the emerging digital economy.

Overcoming industry inhibitions

To progress, the industry needs to overcome the following challenges:

- Time is short. Delegates perceived that telcos had significantly less time to secure strategic control points in the digital economy than at previous brainstorms. Telcos need to act more decisively now in payments, advertising, creating new forms of ‘OTT’ communications, identity and cloud services.

-

Money is hard to find. The business cases for some of the new models are complex and the economics are different from traditional telco business models. We know because we have been working on many recently, and have also been recommending important new evaluation metrics. It’s not straightforward, nor is it easy to fill the gap left by the predicted decline in the current model, but it is possible to create new value.

- Technology is a tool, not a strategy. The business case for LTE, for example, is hard to make without new service revenues in addition to access, which somewhat begs the question of who and what is leading this major industry investment.

- The right people are hard to find. 95% of delegates thought there is a serious shortage of the internal skills needed to manage, innovate and deliver very different types of propositions. Understanding, addressing and filling this gap is a vital priority.

-

Customers will not solve the industry’s problems. Most customers – upstream and downstream - do not understand how telcos could help them in new ways. Our research shows a range in comprehension and belief in telcos’ abilities, so telcos need to work harder to create and sell new solutions.

- It’s tricky to organise innovation and change at scale. The operators that are starting to take action face a complex organisational challenge: should innovation be built into the core business or established in a new unit? In the core it is closer to the heart but also more vulnerable to the organisation’s white blood cells (the ones that attack unrecognised intruders). In a separate unit it’s easier to grant more freedoms but it’s much more difficult to integrate and change the core.

-

Collaboration: the Prisoners’ Dilemma. Many of the new business models will only work effectively if telcos cooperate on a common approach. This is usually slow and difficult (witness the slow progress of RCS-e and the demise of WAC). There is also regulatory uncertainty around industry collaboration, and fear of the regulator is quite reasonably a powerful internal inhibitor in telcos. Additionally, some players perceive they could achieve competitive advantage by ‘going it alone’. A way through this dilemma needs to be navigated, and our recent analysis suggests some new ways to think about this.

- It’s hard to change a winning formula (even when you are losing). Financial markets have been keen on telcos’ relative stability and cash flows in turbulent economic times. At the same time there are also those high up in telco organisations who have known nothing but success with the existing model and who will argue to defend the status quo. Yet the financial markets, well known as fickle and irrational beasts, will at some point start to be much more sensitive to the structural change in the telco industry and seek a new direction. Unreasonably perhaps, they will expect change to happen quickly, and if this is not apparent, they will demand new leaders but by then it may be too late.

Next steps for STL Partners and Telco 2.0

Telco 2.0 first described the core challenges facing the industry six years ago in ‘How to make money in an IP world', and proposed the ‘two-sided telecoms business model' as a key part of the solution four years ago. Over the last year we have published the ‘Roadmap to New Telco 2.0 Business Models' describing core innovations needed, and ‘Dealing with the Disruptors - Google, Apple, Facebook, Skype and Amazon' outlining strategies in the adjacent competitive landscape.

We're now driving a range of implementation projects with individual players and collaborative consortiums and will be publishing a further detailed Telco 2.0 implementation guide later this year. Through our research we will also be benchmarking telcos' strategies, to help the capital markets better understand how to make investment choices in the industry, and looking in-depth at creative strategies in voice and messaging, m-commerce, cloud services and M2M, as well as continuing our work with the World Economic Forum on one of the biggest prizes, how telcos can play a pivotal role in enabling the emergence of a new class of economic asset, ‘Personal Data'.

We will also be running further invitation only Executive Brainstorms in Dubai (November 6-7, 2012), Singapore (4-5 December, 2012), Silicon Valley (19-20 March 2013), and London (23-24 April, 2013). Email or call +44 (0) 207 243 5003 to find out more.

Support for Key Findings

The Platform is burning

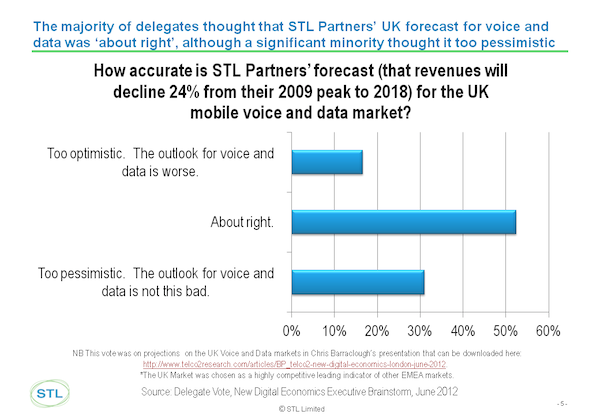

Figure 2 – Delegates broadly agreed with STL’s UK Revenue forecast

Chris Barraclough, MD and Chief Strategist, Telco 2.0 / STL Partners, presented an example analysis of voice and data revenues from the UK market, and predicted a 24% decline from the peak in 2009 to 2018.

Delegates broadly supported this analysis, with over half saying they thought this was ‘about right'. We will be conducting and publishing further analysis in the top 5 European markets over the next few months.

NB The original ‘burning platform' reference comes from this article describing a choice between certain death and possible death, and is now used to describe a situation where people are forced to act by dint of the alternative being somewhat worse. Nokia recently made ‘burning platform' a famous phrase in the handset part of the telecoms sector, but it's now relevant to telcos themselves as they face significant declines in their core revenues.

To read the note in full, including the following sections detailing support for the analysis...

- Time is short

- Money is hard to find

- The right people are hard to find

- Customers will not solve the industry's problems

- It's tricky to organise innovation and change at scale

- Collaboration: the Prisoners' Dilemma

- It's hard to change a winning formula (even when you are losing)

- Next steps

...and the following figures...

- Figure 1 - The burning platform illustrated: e.g. forecast decline in UK revenues

- Figure 2 - Delegates broadly agreed with STL's UK Revenue forecast

- Figure 3 - Time is running out for telcos

- Figure 4 - The business case for Telco OTT Voice and Messaging is complex

- Figure 5 - Telcos need to transform skills, systems, structures and incentives

- Figure 6 - Upstream customers' views on telco capabilities

- Figure 7 - KPN is building innovation into the core rather than a separate business unit

- Figure 8 - The Prisoners' Dilemma

- Figure 9 - It's difficult to get the timing of new investments right

...Members of the Telco 2.0 Executive Briefing Subscription Service and the Telco 2.0 Transformation stream can download the full 16 page report in PDF format here. Non-Members, please subscribe here. For this or other enquiries, please email / call +44 (0) 207 247 5003.