| Summary: Telcos traditionally think of every new service as a profitable new revenue source, and create services in silos with little thought for the total customer experience and overall creation of value. In contrast, the big internet and tech players typically build their future offerings as part of an integrated strategy to raise the overall value of their platforms. This extract from ‘A Practical Guide to Implementing Telco 2.0’ shows key lessons for telcos. (September 2012, Executive Briefing Service, Dealing with Disruption Stream.) |

|

Below is an extract from this 12 page Telco 2.0 Briefing Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service and the Dealing with Disruption Stream here. Non-members can subscribe here and for this and other enquiries, please email / call +44 (0) 207 247 5003.

For the last six years, STL Partners has been working with telcos and their partners on the development of a new telecoms business model – ‘Telco 2.0’. We have undertaken a significant amount of research into what Telco 2.0 could look like and explored in ‘The 2-Sided Telecoms Market Opportunity’ and ‘The Roadmap to New Telco 2.0 Business Models’, and other key research, how telcos can:

We have now published Part 1 of A Practical Guide to Implementing Telco 2.0 which focuses principally on how to implement Telco 2.0. It gathers some of the techniques and lessons that STL Partners has been deploying with clients that are now implementing Telco 2.0.

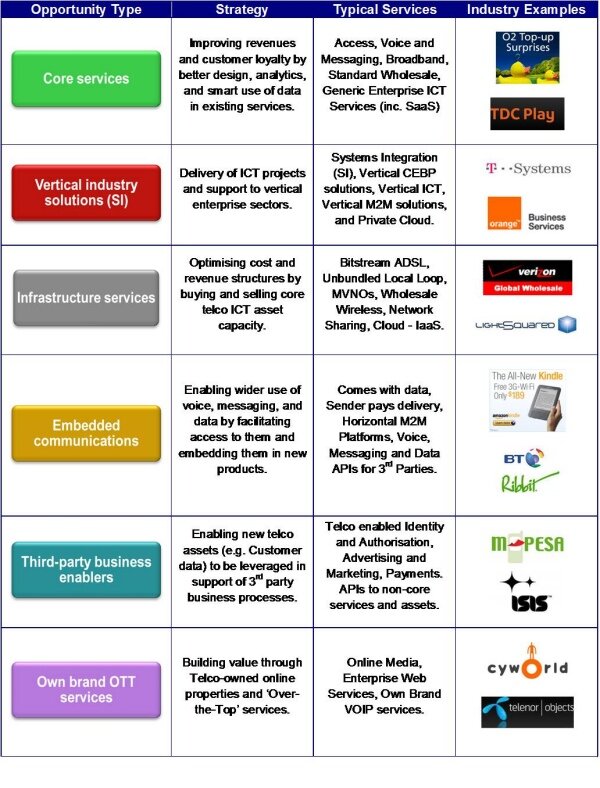

The following edited extract, available in full to members of the Executive Briefing Service, explains the danger of considering each of the six Telco 2.0 opportunity areas as a separate value source by exploring the platform strategies of the internet players such as Google, Apple, Facebook, Amazon and Microsoft. It illustrates how some areas lose money and how this ‘loss-lead’ approach makes sense as long as the overall value of the platform rises, and concludes that telcos must think about opportunities in an integrated ‘joined up’ way.

In a tough global economy, with many telco markets rapidly reaching maturity, and facing competition from so-called ‘Over-The-Top’ (OTT) communications services, telcos face some difficult trading conditions.

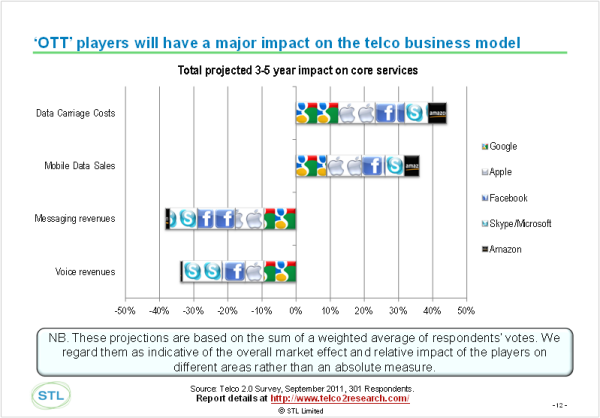

In Euro telcos: fiddling while the platform burns? we shared an early sight of forecasts we’re working on of core services revenues, showing a fairly pessimistic snapshot of long term revenue decline (in this instance, based on UK revenues). In research conducted for the strategy report Dealing with the 'Disruptors': Google, Apple, Facebook, Microsoft/Skype and Amazon we found that many industry senior execs believe that a major cause of the revenue decline were so-called ‘Over-The-Top’ (OTT) players.

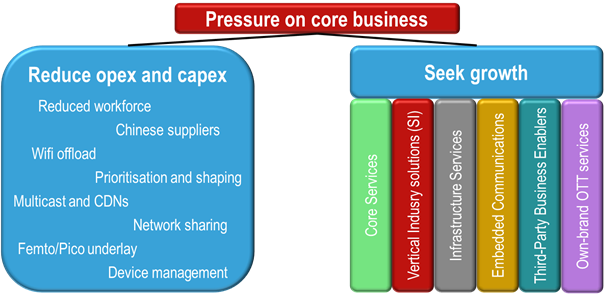

Against this tough background, most telco CEOs appreciate that they cannot just cut their businesses to growth (or even maintenance for some) – they need new sources of value creation.

(NB. The concept of ‘Telco 2.0’ is not confined to the potential growth areas, but about enabling the telco business model to adapt and survive overall, as described in detail in Telco 2.0: Killing Ten Misleading Myths and The Roadmap to New Telco 2.0 Business Models.)

As we have also illustrated previously, there are many new services within the six Telco 2.0 opportunity areas which can generate value for telcos.

But it is highly unlikely that every service, even if ‘successful’ in terms of becoming big and popular, will directly generate revenue. Indeed, some services should be designed from the outset to be free and loss-making for the telco. Why? Because by doing this the telco can generate more value in other areas. Google does this with free search for consumers – it makes more money from advertisers owing to high search volumes.

Many telco managers simply do not appreciate this point. In telcos, each and every service tends to evaluated independently and if it does not meet stringent business case benchmarks, it is not progressed. This tends to lead to some creative use of pricing and volume assumptions in many business cases to ensure that services get over the hurdle.

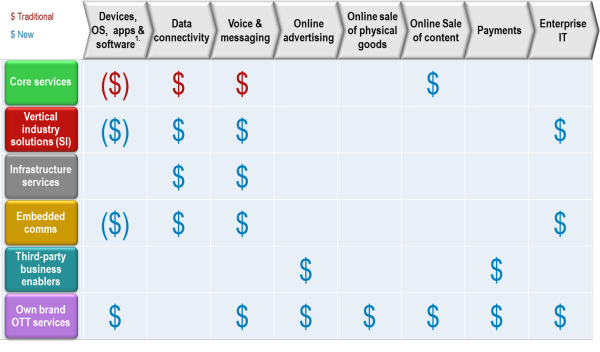

To see why this is misguided, it is helpful to think of current and future telco services as part of a digital value chain (as in Figure 4 below). There are devices, operating systems and applications (first segment of the value chain) that use data connectivity (second segment) for a range of applications and services such as advertising and marketing, the sale of physical goods and digital content, making payments and delivering enterprise solutions. Voice and messaging too is increasingly become another data service and this is set to increase as IP networks become end-to-end on fixed and mobile.

As already noted, each of the telco opportunity areas contain services that can be offered in different segments of the value chain:

Essentially, telcos can theoretically offer a one-stop shop for consumers and enterprises across the digital value chain. The challenge at the moment is that telcos think of each service, and each stage of the value chain, as a profitable new revenue source. Services are thus created in silos with little thought given to the customer experience across the value chain and, importantly, to the creation of value across all stages of the chain.

As Figure 4 shows, telcos see opportunities for value creation in every single value chain segment (although not every opportunity area covers every segment).

1. Devices, OS, apps & software have been placed in brackets because the handset subsidies that telcos offer for devices could be construed as a source of profitable revenue or as an enabler of data and voice and messaging revenues depending how they are priced and accounted for.

Why does it matter that telcos are seeking to generate profitable growth in each segment of the value chain? After all, profit for shareholders is the ultimate goal. The problem with this strategy stems from the integrated platform strategies of the internet players – and the challenges of competing with them.

...and the following figures...

...Members of the Telco 2.0 Executive Briefing Subscription Service can download the full 12 page report in PDF format here. Non-Members, please subscribe and the Dealing with Disruption Stream here. For this or other enquiries, please email / call +44 (0) 207 247 5003.

Companies and technologies covered: Apple, Google, Facebook, Microsoft, Skype, Amazon, Telco 2.0, platforms, business model, strategy, innovation.